SOAP API

API method with e-mail authorization :

b2c_issuer_agreement_order

Welcome to Maventa integration guide!

This guide will tell you how to connect your financial system to Maventa e-invoicing and document exchange service. See how to move from testing to production, what API methods to use for different functionality, as well as get useful tips and information about how the integration works.

Let’s go!

The integration process includes setting up the integration, testing it and finally moving to production.

Before entering the production environment all integrators are required to fill in and sign Maventa Integration Agreement that outlines important arrangements such as billing and support. The agreement is given to you by your integration contact point.

To get the necessary API keys to testing and production follow the steps described below.

If you haven’t quite yet decided what type of integration to make, see our Overview section. In there you can find guidance how to define the integration scope and level based on the needed functionality and automation.

To start using Maventa APIs, open a test account for your company from here.

When you have registered the company account in testing, contact Integration Care (integrations@maventa.com) or your integration contact point to convert your account into a partner account. At the same time they will create a vendor_api_key for you. This key is linked to your partner account will be used to identify your software interaction with the API.

After having the necessary API keys you can start building the integration. Follow feature specific guides for detailed instructions on sending, receiving, account & settings configuration and service activation.

Make sure you also understand how the testing environment works.

When integration is created and tested in the testing environment, next step is to move to production. To get the necessary keys follow the same process as in testing.

First create a regular account for your company in production from here. After that contact Integration Care (integrations@maventa.com) or your integration contact point to change the account to partner and create the vendor_api_key.

When can the integration be taken to production

Before moving to production, it is good to check that the basic operations around the integration are working. If possible, Maventa likes to organise a short test/demo session with the integrators to go over together

Company and service activation

Sending an invoice or a batch of invoices, to specific external recipients

Receiving

Extra

To use the API you need three different API keys, which are used in almost every request towards Maventa API:

user_api_key (identifies a single user, required in all interaction with API)company_uuid (identifies a single company, required in all interaction with API)vendor_api_key (identifies a partner, required in all partner interaction with API)User_api_key and the company_uuid are returned when you create new users and companies. The vendor_api_key is given to you by your integration contact point from Maventa.

In SOAP API, authentication is performed by providing all keys on each request.

In REST API, authentication is performed by using oauth2 standard tokens. See more at REST API Authentication.

When using the API keys, make sure they are written as is and ensure there are no extra blanks before or after the key to avoid errors.

The purpose of the vendor_api_key is to identify the partner the customer and their transactions “belong” into. This is necessary for correct billing, reporting and support handling. It is very important that Partner and ERP integrations always use their own vendor_api_key in all API calls. Actions performed without supplying vendor_api_key will not be related to any vendor / partner. All actions submitted without specifying vendor_api_key will be billed directly to related customer, based on general price list.

Usually, if a partner is developing multiple different ERP systems and wants to get their customer transactions sorted by ERP, a partner wants to have a different vendor_api_key for each ERP. In general, this key is then ”hard-coded” into the software or at least hidden so that a user cannot change it.

Note also that the testing and production endpoints of the API use different API keys. API keys from testing will work on production and vice versa. Errors like USER NOT FOUND mean that the user_api_key is wrong for that environment. Please, make sure you are using the correct API endpoint for your API key.

In Addition to the above mentioned 3 API keys, 2 extra keys are also supported. These keys allow ERPs to pass license information along through our system, onto billing systems. These keys are supported in all our API versions and are optional:

license_key (License key of software making the call (255 characters max) From systems integrated to VLS this is the activation key)license_meta (License metadata in JSON string format. license_meta parameter will be stored in a TEXT database field (65535 characters); if the JSON string exceeds that size, it will be cut and inconsistent data will be stored){

"licensing":"Some License",

"erp_name":"My ERP",

"erp_version":"1.0",

"erp_user":"Some User"

}In the testing server, electronic, email and print sends outside Maventa are only simulated, but internal sends work as in the production environment. Also all the notification emails related to account management and error handling are sent out to the real recipients (e.g. do not use something like test@test.com since that domain really exists meaning that the e-mail address might also exist). Note! If there is a need to test the invoice sending via email route for a real recipient please contact us or support@maventa.com and we can enable it for a specific account.

It is also good to note, that the testing environment is also used for internal testing, which means that it can differ from the production environment from time to time. The database of the testing server might be unavailable at times, and the server may be emptied without notice. Also for data privacy do not use real/production data in the testing environment.

APIs to use: SOAP API or REST API

Invoices are sent by providing an XML file and specifying other necessary data as parameters on the API call. After the send you will get an ID that can be used to monitor invoice delivery.

You can use the same functionality to send invoices based on your preference either using SOAP or REST API.

To send an invoice make sure you have:

See more information by opening the guides for

How invoice gets delivered, how to give the delivery address and look up invoice recipients

How to send an invoice. What are the possible invoice statuses, how to use webhooks, resend and handle errors

Invoice image and attachment handling

Customers can use Maventa to receive invoices through various networks. Scanning service can be activated for PDF invoices.

Everything is delivered easily through one API. Invoices are received first to the customer’s Maventa account from where they are downloaded to the receiving financial system.

Use webhooks to build seamless receiving flow and integrate automated Detect service checks to add security and automation in the invoice processing. Fraud reporting functionality lets customers report suspicious senders and contribute to preventing invoice fraud.

How to build your invoice receiving flow, good to know about invoice networks in different countries and recommended routines for fetching the invoices.

Integrate Detect as part of the invoice receiving flow and support invoice processing automation with smart invoice and supplier checks.

Add the fraud reporting functionality into your system. And let users, with a few clicks, do reports of suspicious invoice senders.

What are the supported document XML formats

How validation is handled

Finvoice format specific handling

Announcements about past and future changes

API to use: SOAP API or REST API

All companies using Maventa have an own account that is registered with unique business ID and company details. After registration company settings can be configured, including activation of different services and networks. Before account is ready to be used fully, it needs to be in verified state to ensure customer authentication process has been completed.

Company accounts will always be linked to at least one user. Users are created based on an email address. The user can be a real user or a technical/API user only. This gives possibility to create the user set up in a very flexible way, taking into account the integration needs.

In company and user management note that:

company_uuiduser_api_keyOpen and verify company accounts, configure settings, different account types

Create users, manage user settings and roles

Take into use different services and networks enabled by Maventa. Select the services that you want to include in your integration and check here the service specific guides for implementation instructions.

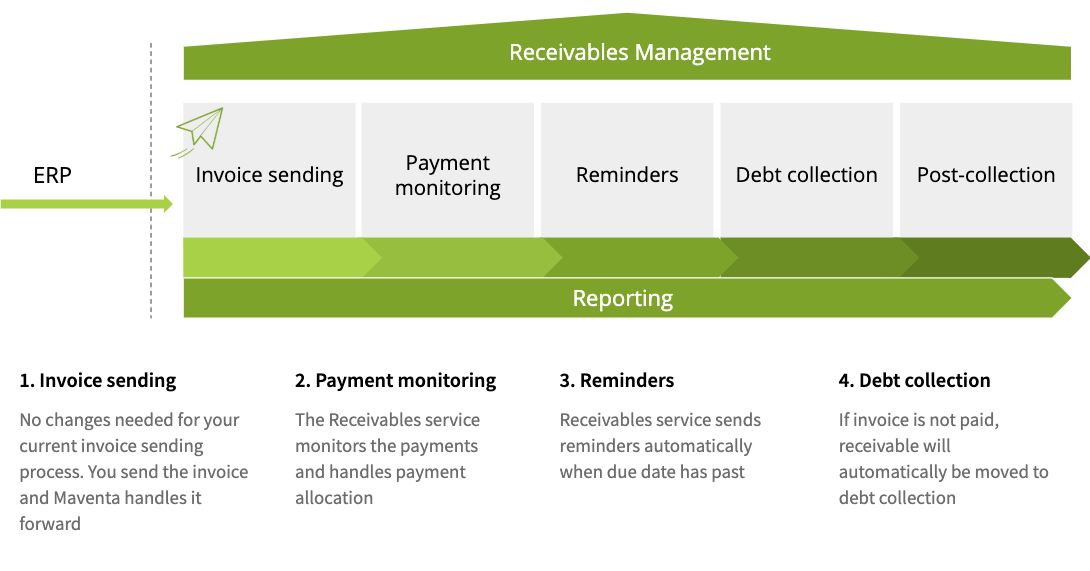

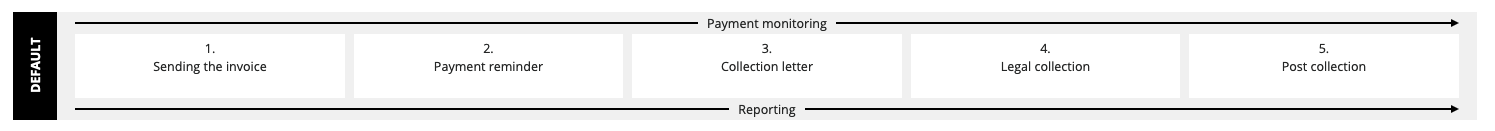

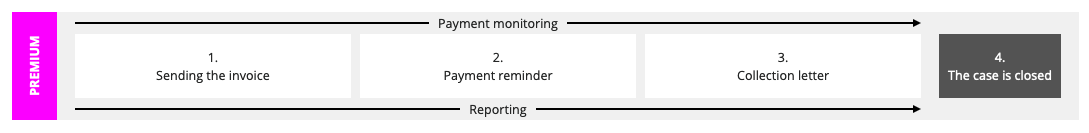

Send invoices to consumers either into their net bank and/or mobile application. Use email or printing service as a fallback options for sending.

Invoices to consumers can be sent through Maventa via email, print or then as an e-invoices or direct payments to the consumer’s netbank. As an additional electronic route we also support sending to digital mail service Kivra and through our print service route, there is a possibility to forwards invoices and letters to consumer’s digital mail box, OmaPosti. Below is the list of all the options that are available for sending invoices to consumers:

e-invoices to netbank

Direct debit

Kivra digital mail service

Email

Print

OmaPosti

For sending invoices to consumers via the email or print route you can force the sending using invoice sending method from either our SOAP or REST APIs.

Consumer e-invoicing (B2C) in Finland enables suppliers to send e-invoices to consumers’ personal netbanks and direct payments to consumers who do not use an online banking service. This service is only available for Finnish companies registered to Maventa. If you need to send invoices from Finnish company to consumers outside Finland only option is to send them via email or by print.

The consumer invoice channel supports sending an invoice image and attachments along with the invoice. In consumer banking, depending on the bank, there may be a link to an invoice display service where the consumer can download the original invoice image and any attached files.

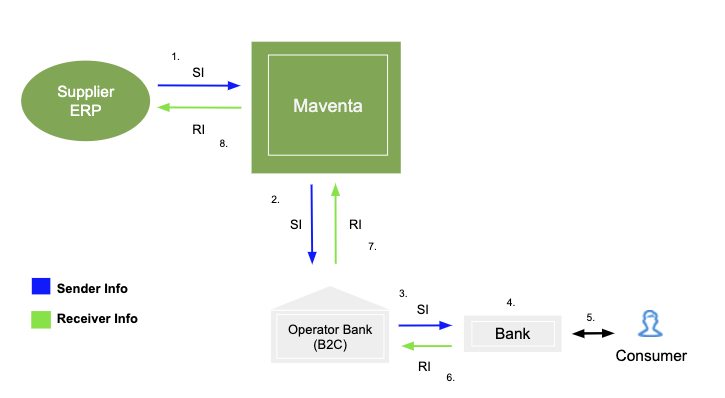

In Finland B2C e-invoicing to netbank requires activation through bank messaging. Suppliers activate the consumer e-invoicing via Sender info SI-message and by that notify the consumers of the option to receive e-invoices from that supplier. Consumers inform that they want to receive e-invoices from the supplier with Receiver info RI-message. The ReceiverProposal message RP-message is used when the supplier asks for the consumer’s e-invoice address.

B2C e-laskutuksen avaus

Ensin yritykselle tulee luoda ja aktivoida Maventa -tili. Aktivointipyynnön yhdeydessä lähtee myös pankkiverkon avauspyyntö pankille käsittelyyn. Pankkiverkon avauksessa kestää muutamia päiviä Danske Bankin kiire tilanteesta riippuen. Vasta kun pankkiverkko on auki, voi aloittaa kuluttajalaskutus sanomien lähettämisen. Alla on listattu molempien rajapintojen metodit tilin luontiin, aktivointiin, pankkiverkon avaukseen ja asetusten määrittelyyn:

REST rajapinta

Käyttäjän luonti: POST /v1/users

Tilin luonti: POST /v1/companies

Tilin aktivointi käyttöön sekä pankkiverkon avauspyynnön lähetys: POST /v1/companies/authorizations

Tilin aktivoinnin tilan kysely: GET /v1/companies/{id}/status

Pankkiverkon tilan kysely (status for the “BANK” network): GET /v1/company/profiles

Tilin asetusten määrittely: PATCH /v1/company/settings

Tilin asetusten tarkastelu: GET /v1/company/settings

SOAP rajapinta

Tilin luonti: register_with_password

Tilin aktivointi käyttöön sekä pankkiverkon avauspyynnön lähetys: authorize_companies

Tilin aktivoinnin tilan kysely: company_auth_status

Tilin asetusten määrittely configure_company

Tilin asetusten tarkastelu (bank_send kertoo pankkiverkon tilan) show_company_configuration

Uuden käyttäjän lisääminen tilille user_create_e

Uusi kuluttajaverkkolaskuja lähettävä asiakas

Luodaan ADD (uusi laskuttajailmoitus) tyyppinen SI-sanoma, joka lähetetään APIn yli joko käyttäen SOAP tai REST rajapintaa (metodit lähetykseen lueteltuna alempana). Täältä löytyy sivu, jolla voi muodostaa laskuttajailmoituksen eri sanomia. Tässä linkki ilmoittamispalvelun soveltamisohjeeseen, josta löytyy sanomien tarkemmat kuvaukset.

Myös RP-sanomat voit lähettää samalla metodilla.

SI-sanoman tilan pollaus voidaan käyttää metodia. Huom! SI-sanoman liikkumiseen operaattorin ja pankin välillä saattaa kestää useampi pvä, jopa 5 päivää. Sanomat ovat tilassa “ok” heti lähetyksen jälkeen ja jos tila ei muutu viiden päivän sisään virheeseen (ERROR) voi sanomien olettaa olevan ok. Myös se että RI sanomia tulee tilille, kertoo siitä että SI sanomat ovat ok.

Kun kuluttaja on valinnut yrityksen laskuttajakseen, palautuu RI-sanoma. Saapuneet RI-sanomat ensin listataan, jonka jälkeen sanomat voi ladata yksitellen listauksessa palautuneiden id tietojen perusteella.

REST rajapinta

Sanomien lähetys (SI, RP): POST /v1/fi_bank_messages

SI ja RP sanomien tilan pollaus: GET /v1/fi_bank_messages/{id}

Saapuneiden RI sanomien id listaus: GET /v1/fi_bank_messages/ri_messages

Yksittäisen RI sanoman lataus id:n perusteella: GET /v1/fi_bank_messages/ri_messages/{id}

SOAP rajapinta

Sanomien lähetys (SI, RP): message_send

SI ja RP sanomien tilan pollaus: message_status

Saapuneiden RI sanomien listaus: ri_message_list

Yksittäisen RI sanoman lataus id:n perusteella: ri_message_show

Asiakas jolla on kuluttajalaskutus käytössä jo toisen operaattorin kautta

Tehdään CHANGE-sanoma, jolla sopimus siirretään vanhalta operaattorilta Maventalle. CHANGE-sanoman saa tehtyä näppärästi olemassa olevan ADD-sanoman pohjalta. CHANGE-Sanoma lähetetään vanhaa yhteyttä pitkin eli vanhan operaattorin kautta pankeille.

Jos myös ERP järjestelmä vaihtuu, kannattaa myös huolehtia siitä, että asiakas saa jotenkin siirrettyä RI-sanomat (tai ainakin niiden tiedot) vanhasta järjestelmästään uuteen järjestelmään. Kun sopimus siirtyy vanhalta operaattorilta Maventa:lle CHANGE -sanomalla, siirtyvät RI-sanomien sopimukset uudelle operaattorille, mutta itse tiedostot eivät. Uudelta operaattorilta näkee siis vain ne uudet RI-sanoma tiedostot, jotka kuluttajat tekevät sen jälkeen kun sopimus on siirretty.

Voitte halutessanne lähettää täysin saman CHANGE sanoman myös Maventa tililtä kaikille pankeille, jotta tiedostot jäävät Maventa -tilille talteen mahdollisia tulevaisuuden muutostarpeita varten.

Uudet RI-sanomat saapuvat jatkossa asiakkaan Maventa tilille, ja näiden lataus onnistuu APIn yli samoilla metodeilla kuin edellisessä tapauksessa (kts. kohta 3.)

There are currently two types of messages supported by Maventa and needed for opening the service and to setting up the consumer e-invoicing, SI-messages and RI-messages. Prerequirement for using the consumer e-invoicing is to have the bank connection activated for the supplier.

In briefly:

SI-message (Sender info) is a notification to the banking system whereby the supplier notifies banks and informs consumers of its readiness to send consumer e-invoices and direct payments. It could be considered as a consumer e-invoicing agreement between the supplier and the bank.

To make a new agreement SI-message with MessageActionCode ADD is sent through Maventa API to each bank the supplier wants to use for consumer e-invoicing. After sending you can poll the status of the sent messages. For SI messages our system shows OK immediately when the message has been sent OK to the operator bank. Between the banks B2C messages can travel with delay up to 1-4 banking days so keep in mind that possible error messages can arrive even after a week. When all is ok new RI-messages will start to flow in.

If the message fails on the bank side you will get an error. In case SI-message is in error state, you can get the errors by first listing error ids and then viewing the error message.

If there is a need to change or add some information for the agreement it can be done by sending a SI-message with the type CHANGE. With the CHANGE message, you can modify almost everything except the billing subject code (PaymentInstructionIdentifier). For bank account information, e-invoice address, and intermediary, both old and new elements are used, but other details are simply updated in the CHANGE message, and the bank replaces the old information with the new one.

If a change is needed for the billing subject code, the old SI-message must be terminated (DELETE message), and a completely new one (ADD) must be sent.

Supplier agreement can be deleted by sending SI-message with the type DELETE. This will also delete all the consumer agreements (RI-messages) linked to this supplier agreement.

Implementation guidelines for creating the SI-messages and a tool for creating messages can be found from Finance Finland’s webpage

Note! Since our B2CFI traffic goes through our intermediator bank, Danske Bank, SI-message must have DABAFIHH defined as a sender operator code!

SI-messages (and RP-messages) can also be sent through our user interface (B2C messages -> Sent messages). The messages can be sent separately as one message per file or then all messages in one file. The latter option is something that you will get when creating the messages using FKL’s tool that can be found from the link above.

REST

To send messages (SI, RP): POST /v1/fi_bank_messages

To poll the status of sent message: GET /v1/fi_bank_messages/{id}

To list error message ids: GET /v1/fi_bank_messages/error_messages

To download a specific error message: GET /v1/fi_bank_messages/error_messages/{id}

SOAP

To send messages (SI and RP): message_send

To poll the status of sent message use: message_status

To list error message ids: error_message_list

To download a specific error message: error_message_show

Billing Subject

Consumer billing includes mandatory billing subject code (PaymentInstructionIdentifier) which is an identifier specified by the sender in the SI-message. Billing subject code is used to identify the reason for payment. Same supplier can have multiple SI-messages with different billing subject. When sending consumer e-invoices this same billing subject code needs to be given in the invoice XML. In Finvoice the billing subject is given in the optional EpiPaymentInstructionID field and in TEAPPSXML description, the corresponding element is HEADER / PAYMENT_INSTRUCTION_IDENTIFIER.

To get this reason for payment to be visualised for the consumers in their netbank or web payment services you will need to specify it in SellerInvoiceTypeText element and with all language code (FI, SE, EN).

<SellerInvoiceDetails>

<PaymentInstructionIdentifier>Vuokra</PaymentInstructionIdentifier>

<SellerInstructionFreeText LanguageCode="FI">Anna viimeisimmän laskun viitenumero </SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="SV">Ge den senaste fakturans referensnummer </SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="EN">Enter the reference number </SellerInstructionFreeText>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="FI">Vuokra lasku</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="FI" SellerInvoiceIdentifierType="01">Viitenumero</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

<SellerServiceCode>01</SellerServiceCode>

</SellerInvoiceDetails>

Bank account information

Supplier’s bank account information is given in the SellerAccountDetails element in SI-message. Bank account numbers must be in IBAN format and supplier needs to define all the account numbers to be used in the consumer e-invoicing. When sending consumer e-invoices the IBAN given in the invoice must match to at least one IBAN given in the SI-message.

List of Finnish banks supporting consumer e-invoicing. We recommend to send SI-message to each of these banks:

| Bank Identifier Code | Bank name |

|---|---|

| AABAFI22 | Ålandsbanken |

| DABAFIHH | Danske Bank |

| HELSFIHH | Aktia |

| ITELFIHH | Säästöpankit, Oma Säästöpankki |

| NDEAFIHH | Nordea Pankki |

| OKOYFIHH | OP-Pohjola-ryhmä |

| POPFFI22 | POP Pankit |

| SBANFIHH | S-Pankki |

RI-messages (Receiver info) can be considered as consumer e-invoicing agreements between the consumer and the supplier and they are always linked to the existing SI-message. There will be as many RI-messages as there are consumers using that particular bank and would like to have the e-invoicing with the supplier in question.

RI-messages with MessageActionCode ADD will be sent to the supplier when a new consumer chooses the supplier as their e-invoicer from their netbank. If a consumer’s information is changed, RI-message with the type CHANGE will be sent to the supplier and if a consumer wants to end the consumer agreement with the supplier RI-message with the type DELETE will be sent. It’s recommended to keep your own consumer register on the ERP side that has the updated status for each RI-messages. We recommend to list and download all the new RI-messages daily and then update your consumer register accordingly. If you send an e-invoice and get a sending error that the consumer agreement is not active, poll for the RI messages, there should be the type delete message for that consumer.

REST

To list received RI-messages: GET /v1/fi_bank_messages/ri_messages

To download RI-message: GET /v1/fi_bank_messages/ri_messages/{id}

To delete RI-message (file) from Maventa account (note! Use this only after you have downloaded the messages to your ERP, deletion cannot be undone): DELETE /v1/fi_bank_messages/ri_messages/{id}

SOAP

To list received RI-messages: ri_message_list

To download RI-message: ri_message_show

To delete RI-message from Maventa account (note! Use this only after you have downloaded the messages to your ERP): ri_message_delete

Handy tip for testing: You can also send RI-messages to your own test account using the same method for sending SI-messages. You can both send and download RI-messages yourself to verify that the integration is working before going to production.

<SOAP-ENV:Envelope xmlns:SOAP-ENV="http://schemas.xmlsoap.org/soap/envelope/" xmlns:eb="http://www.oasis-open.org/committees/ebxml-msg/schema/msg-header-2_0.xsd" xmlns:xlink="http://www.w3.org/1999/xlink">

<SOAP-ENV:Header>

<eb:MessageHeader SOAP-ENV:mustUnderstand="1" eb:id="20200731110324320000" xmlns:eb="http://www.oasis-open.org/committees/ebxml-msg/schema/msg-header-2_0.xsd">

<eb:From>

<eb:PartyId>FI4941452835555555</eb:PartyId>

<eb:Role>Sender</eb:Role>

</eb:From>

<eb:From>

<eb:PartyId>SBANFIHH</eb:PartyId>

<eb:Role>Intermediator</eb:Role>

</eb:From>

<eb:To>

<eb:PartyId>003712345678</eb:PartyId>

<eb:Role>Receiver</eb:Role>

</eb:To>

<eb:To>

<eb:PartyId>DABAFIHH</eb:PartyId>

<eb:Role>Intermediator</eb:Role>

</eb:To>

<eb:CPAId>yoursandmycpa</eb:CPAId>

<eb:ConversationId>nnnn</eb:ConversationId>

<eb:Service>Routing</eb:Service>

<eb:Action>ProcessReceiver</eb:Action>

<eb:MessageData>

<eb:MessageId>2020083111032432000022</eb:MessageId>

<eb:Timestamp>2023-09-31T11:03:24+03</eb:Timestamp>

<eb:RefToMessageId>20150609223129270000</eb:RefToMessageId>

</eb:MessageData>

</eb:MessageHeader>

</SOAP-ENV:Header>

<SOAP-ENV:Body>

<eb:Manifest eb:id="Manifest" eb:version="2.0">

<eb:Reference eb:id="Finvoice" xlink:href="20200731110324320000">

<eb:schema eb:location="http://www.pankkiyhdistys.fi/verkkolasku/finvoice/finvo" eb:version="2.0"/>

</eb:Reference>

</eb:Manifest>

</SOAP-ENV:Body>

</SOAP-ENV:Envelope>

<?xml version="1.0" encoding="ISO-8859-15"?>

<?xml-stylesheet type="text/xsl" href="FinvoiceReceiverInfo.xsl"?>

<FinvoiceReceiverInfo Version="2.0" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:noNamespaceSchemaLocation="FinvoiceReceiverInfo.xsd">

<MessageDetails>

<MessageTypeCode>RECEIVERINFO</MessageTypeCode>

<MessageTypeText>VASTAANOTTAJAN ILMOITUS</MessageTypeText>

<MessageActionCode>ADD</MessageActionCode>

<MessageActionCodeIdentifier>00</MessageActionCodeIdentifier>

<MessageDate Format="CCYYMMDD">20200831</MessageDate>

<SenderInfoIdentifier>testi</SenderInfoIdentifier>

</MessageDetails>

<SellerPartyDetails>

<SellerPartyIdentifier>1234567-8</SellerPartyIdentifier>

<SellerOrganisationNames LanguageCode="FI">

<SellerOrganisationName>Your Software Oy</SellerOrganisationName>

</SellerOrganisationNames>

<SellerOrganisationNames LanguageCode="SV">

<SellerOrganisationName>Your Software Oy</SellerOrganisationName>

</SellerOrganisationNames>

<SellerOrganisationNames LanguageCode="EN">

<SellerOrganisationName>Your Software Oy</SellerOrganisationName>

</SellerOrganisationNames>

<SellerOrganisationBankName>Your Software Oy</SellerOrganisationBankName>

<SellerPostalAddressDetails>

<SellerStreetName>Tie 6</SellerStreetName>

<SellerTownName>Helsinki</SellerTownName>

<SellerPostCodeIdentifier>00200</SellerPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>SUOMI</CountryName>

</SellerPostalAddressDetails>

</SellerPartyDetails>

<InvoiceSenderInformationDetails>

<SellerWebaddressText>www.yritys.fi</SellerWebaddressText>

<InvoiceSenderAddress>00372345678</InvoiceSenderAddress>

<InvoiceSenderIntermediatorAddress>DABAFIHH</InvoiceSenderIntermediatorAddress>

</InvoiceSenderInformationDetails>

<SellerAccountDetails>

<SellerAccountID IdentificationSchemeName="IBAN">FI4941452835555555</SellerAccountID>

<SellerBic IdentificationSchemeName="BIC">NDEAFIHH</SellerBic>

</SellerAccountDetails>

<SellerInvoiceDetails>

<PaymentInstructionIdentifier>Lasku</PaymentInstructionIdentifier>

<SellerInstructionFreeText LanguageCode="FI">Syötä yritykseltä saamasi rekisteröintitunnus.</SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="SV">Ange registrerings-ID du fått från företaget.</SellerInstructionFreeText>

<SellerInstructionFreeText LanguageCode="EN">Enter the registration ID you received from the company.</SellerInstructionFreeText>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="FI">Liikuntamaksu</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="FI" SellerInvoiceIdentifierType="99">Rekisteröintitunnus</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="SV">Motionsavgift</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="SV" SellerInvoiceIdentifierType="99">Registeringsnummer</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

<SellerInvoiceTypeDetails>

<SellerInvoiceTypeText LanguageCode="EN">Exercise fee</SellerInvoiceTypeText>

<SellerInvoiceIdentifierText LanguageCode="EN" SellerInvoiceIdentifierType="99">Registration ID</SellerInvoiceIdentifierText>

</SellerInvoiceTypeDetails>

</SellerInvoiceDetails>

<ReceiverInfoTimeStamp>2023-09-19T11:03:24+03</ReceiverInfoTimeStamp>

<BuyerPartyDetails>

<BuyerOrganisationName>Matti Mallikas</BuyerOrganisationName>

<BuyerPostalAddressDetails>

<BuyerStreetName>katu 1</BuyerStreetName>

<BuyerTownName>PORVOO</BuyerTownName>

<BuyerPostCodeIdentifier>06100</BuyerPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>SUOMI</CountryName>

</BuyerPostalAddressDetails>

</BuyerPartyDetails>

<InvoiceRecipientDetails>

<InvoiceRecipientAddress>FI4941452835555555</InvoiceRecipientAddress>

<InvoiceRecipientIntermediatorAddress>SBANFIHH</InvoiceRecipientIntermediatorAddress>

<SellerInvoiceIdentifier>123456</SellerInvoiceIdentifier>

<InvoiceRecipientLanguageCode>FI</InvoiceRecipientLanguageCode>

</InvoiceRecipientDetails>

<BuyerServiceCode>00</BuyerServiceCode>

<ConversionDetails/>

</FinvoiceReceiverInfo>

RP-message (Receiver Proposal message) is used when the supplier asks for the consumer’s e-invoice address before e-invoices can be sent. When a consumer accepts the proposal, a RI-message is sent to the supplier. RP-message is a way to get more consumers to take the e-invoicing into use.

• The supplier and the consumer in question have agreed that the supplier requests the e-invoicing address with an RP message

• Supplier has consumer e-invoicing agreement with the banks (SI-messages are sent and ok)

• The PaymentInstructionIdentifier field has the same data content in the RP as it does in the SI-message

NOTE! If the Customer has not reacted within 30 calendar days, the Bank deletes the RP-message from the consumer’s netbank. The deletion is not in any way notified with an ack message.

Implementation guidelines for creating the RP-messages and more information for the process can be found from Finance Finland’s webpage

Consumer e-invoicing can be deactivated by sending SI-messages with the type DELETE. This will delete the supplier agreements with the banks and remove the supplier from the list of companies providing consumer e-invoicing from the netbanks. Deactivation and deleting of SI-messages will also delete all the consumer agreements (RI-messages) linked to the supplier agreement in question. In case there is only a need to change the service provider or other information on the SI-messages there is no need to delete the existing agreements but instead the information can be changed easily by sending SI-messages with the type CHANGE.

In case the service provider will be changed you will need to send SI-messages with the type CHANGE from the old service provider and with those SI-messages inform which will be the new service provider. In this way all the existing consumer agreements (RI-messages) will follow along to the new service provider and there is no changes needed to be done by the consumers. Note! It might take few banking days for the SI messages to travel to each bank and to get validated so you should be prepared for the possible errors to arrive few days after the sending of the messages. This means that you should not close down the old connection immidiately but instead you should wait for couple of days (5 days should be enough). Only after those few days if no errors arrive you can close the old connection. Note! RI-message files from the old service provider are not moved to the new service provider in any automated way. You will need to make sure you have downloaded the files or saved the information to your end.

InvoiceSenderAddress and InvoiceSenderIntermediatorAddress should have the current sender information and with NewInvoiceSenderAddress and NewInvoiceSenderIntermediatorAddress you can inform the new sender information:

<InvoiceSenderInformationDetails>

<InvoiceSenderAddress>003712345678</InvoiceSenderAddress>

<InvoiceSenderIntermediatorAddress>DABAFIHH</InvoiceSenderIntermediatorAddress>

<NewInvoiceSenderAddress>003787654321</NewInvoiceSenderAddress>

<NewInvoiceSenderIntermediatorAddress>NDEAFIHH</NewInvoiceSenderIntermediatorAddress>

</InvoiceSenderInformationDetails>

Kivra is a digital mail service that allows consumers to receive invoices, letters, and various documents in an electronic format. To learn more about Kivra, visit their website at https://kivra.fi/.

Companies can utilize Kivra through Maventa to send invoices to consumers. Also, consumers have the option to make payments for the invoices through the service.

Kivra functions as one of the electronic routes (relay) in our automated routing, positioned after e-invoice and before email routes. If an invoice is sent without the consumer’s full e-invoice address (IBAN and bank operator), lookup towards Kivra’s consumer registry is performed based on the data on the invoice. If a consumer has a Kivra account, and hasn’t blocked invoices from the sender in question (based on the sender’s bid), invoice is delivered to their Kivra account. In case the Kivra route fails, the invoice is routed via the next available route, such as email or print.

Kivra delivery can now also be attempted as part of the print delivery route. In the POST /v1/invoices, you can include a new optional parameter under print_settings: allow_kivra_fi

When this parameter is set, the system will attempt to deliver the invoice via Kivra before defaulting to print — even if print is the only explicitly allowed route. This allows for Kivra delivery attempts without requiring e-invoice route activation.

The consumer match against Kivra’s registry is performed using one of the following sets of data from the invoice XML:

OmaPosti is an application that allows consumers to receive their letters electronically instead of in a paper form. In case a consumer invoice is going to print, our print service provider will do a look up towards the OmaPosti consumer registry. When a consumer has an active OmaPosti account and has not opted out of receiving digital letters from a sender in question (based on the Maventa account’s OVT code), the invoice will be redirected to the consumer’s OmaPosti account instead of being delivered as a paper document. However, if the consumer does not have an OmaPosti account, the invoice will be printed and sent as a paper letter to the consumer.

To determine if a consumer has an OmaPosti account, a combination of their name and postal address or social security number is used for identification. It is good to keep in mind that while a social security number (ssn) can be used as an identifier, it is highly recommended not to include such sensitive information on invoices.

It is also possible for the sender to exclude an invoice from being sent through the OmaPosti route by setting a parameter print_settings[prevent_digital_post] to “true” while using POST /v1/invoices to send or setting the parameter prevent_digital_post to “true” while using the invoice_put_invoice_with_metadata method for sending.

In summary, OmaPosti provides a digital alternative for receiving letters and in Maventa OmaPosti works only through the print route. Specific criteria mentioned above are used to determine whether an invoice should be sent electronically or as a physical document.

Invoices can be sent through Maventa to consumers via direct debit (AvtaleGiro), netbank and Vipps (eFaktura), Digital postkasse innbygger (DPI, only for municipalities), e-mail and print. The invoice can be forced to go to a specific route like eFaktura or it can be specified to try all routes in a predefined order to reach the consumer with the help of our routing logic. Activation comes at no cost, and there are no extra monthly or yearly charges associated with using the service. Your only expense will be for the transactions you make.

Updates regarding the consumer invoicing in Norway:

There are two vendor agreements that needs to be signed in order to use both the direct debit and eFaktura (netbank and Vipps) routes.

Before the company can send consumer invoices through Maventa, or enable any of the extra features like the direct debit solution, the main vendor agreement must be activated. The main vendor agreement enables the sending of eFaktura (netbank and Vipps) and using the fallback routes e-mail and print. To enter into an agreement with Visma is enough to reach all the banks and the company does not need a separate agreement with their own bank to enable the consumer invoicing.

Only a norwegian company account in Maventa can activate the agreement and send invoices to Norwegian consumers.

When activation is initiated either through the API or UI, Maventa does a query to MPS (Mastercard payment services) to check if the given organisation number already has an existing agreement through another service provider. If another agreement exists, the person with signatory rights for the company needs to sign an agreement through Visma Sign’s electronic signing service to give consent for Visma to move the old agreement to Visma. Note! It is the company’s responsibility to make sure that the old agreement is closed, so that they do not come into a conflict with this agreement.

If the company does not have existing consumer agreement, the service is activated immidiately without the need to sign a separate agreement through Visma Sign as the company has already approved the Visma TOS.

Activation timeline: MPS creates the agreement immediately but it usually takes about an hour for the information to get updated on Maventa as we fetch new agreements every 30 minutes. For the agreement to get activated within all the banks, it can take up to 24 hours since each bank fetches agreements from MPS under different timelines. Usually it only takes a couple of hours.

API methods for activating the main vendor agreement:

API Method without e-mail authorization:

Using the AX REST api https://ax-stage.maventa.com/swagger/#!/company/postV1CompanyProfiles method. This method will return error unless the vendor_api key is included in a list of allowed signers. Example:

{ “profiles”:[“INVOICE”], “network”:”BANK”, “network_settings”: {

“name”:”Signer name”,

“email”:”Signer email”,

“agreement_signed”:”true”} }

GET /v1/services/b2cno https://swagger.maventa.com/?urls.primaryName=STAGE%20-%20AutoXChange%20API#/services/getV1ServicesB2cno to get status of the B2CNO/main agreement?

“Yes to All” registry or “Ja takk til alle” registry (JTTA) is a way for consumers to accept e-invoice from all the suppliers. When doing this the consumer gets added into a MPS registry and gets assigned an eFaktura identifier which is then the same identifier used by all the supplier when sending e-invoices to that particular consumers in their netbank. With the old, already deprecated eFaktura references (CVR) there was a direct connection between the specific supplier and the consumer, but an eFaktura identifier is more general that all suppliers can use. By activating the “Yes to All” from their netbank, consumer accepts e-invoices from all suppliers that are able to send e-invoice. When “Yes to All” is activated there is no need for the supplier to send out any consumer requests and the first invoice can be sent directly to the consumer’s netbank.

Maventa does not fetch and store the eFaktura Identifiers, but instead uses the Yes to All registry for lookup to get the consumer’s eFaktura identifier based on the data given on the invoice including email, phone, address, name and SSN. Order and combination of the data used:

Some ERPs have their own direct API connection to MPS to do the JTTA lookup to get the eFaktura identifier and then use that when sending invoices to Maventa.

AvtaleGiro is a direct debit payment method used throughout the Norway.

Direct debit solution through Maventa means that when the direct debit invoice is sent, the deduction file is created automatically by MPS based on the data from the invoice. By using Maventa solution the supplier does not need to create the deduction file themselves and then sent it through another channel as the direct debit has worked before. Addition to the automatic creation of the deduction file, our solution also handles the invoice notification.

NOTE! This is not to be confused with a current combo solution thorough Maventa where the invoice notification is sent by Maventa but the deduction file must be created elsewhere and sent to MPS either through direct integration from the ERP to MPS or through AutoPay.

To get started the with the AvtaleGiro the supplier needs a direct debit agreement with their bank. This is a manual process today and it is handled outside of Visma. In the agreement with the bank the supplier must specify customer ID as 229221. This is to identify the direct debit solution with Visma and to give consent for Maventa to have an authority to send deduction files on the behalf of the supplier, and to fetch their mandates.

If the supplier already has an active AvtaleGiro agreement with another service provider, they need to authorize the take-over process using Visma sign. During activation the supplier is required to enter an e-mail address to a person within the company that has signatory rights. Once the agreement is signed the activation itself starts and we send the necessary data to MPS.

If another agreement exists, the person with signatory rights for the company needs to sign an agreement through Visma Sign’s electronic signing service to give consent for Visma to move the old agreement to Visma. Company is responsible for making sure the old agreement is closed. Note! If the supplier already has an active agreement and are already sending deduction files through another service provider, activation in Maventa does not stop the old route like it does for eFaktura to netbank. Meaning they can send invoice combo through us and deduction file through old channel and it will not be stopped at MPS. However, the mandates can only be fetched from MPS by Visma.

If the supplier already have an active agreement with their bank they can activate direct debit through Maventa and we configure the agreement with MPS.

Maventa needs the following information from the company:

Agreement can be activated through the API or UI.

Mandates will be collected and stored in Maventa.

Once the general AvtaleGiro agreement is in place, a payer can create one or more payment mandates, each of which is an agreement between the payer and the payer’s bank to automatically pay recurring bills to a specific payee on the due date. Mandates can only be registered in connection with payees that offer AvtaleGiro. Mandates include the following information:

KID – identifies the payer/payee relationship

Payer’s account number

Payee’s account number

Amount limit – the maximum amount per month which will be automatically paid to the specific payee connected to the mandate. This limit is set by the payer and is considered private information; it is not shared with the payee

Notification setting – The payer specifies if they would like to be notified each time a new payment is scheduled

Payment mandates can be initiated in several ways:

The payer can register a mandate in their online bank using suggestions from the bank which are based on historic payments

The payer can use Mastercard Payment Services’ suggestions at https://pvu.nets.no/pvu-suggestions/avtalegiro. Suggestions are based on historic payments and are not available for all banks

If the payee offers Mastercard Payment Services' E-Agreement service, the payee can send the payer to Mastercard Payment Services’ web-based onboarding solution. This solution requires the payer to authenticate using BankID, and is generally linked from the “my account” area of the payee’s website

A paper or PDF coupon which is provided by the payee can be filled out by the payer and returned. The payee will then forward the slip to Mastercard Payment Services for processing, either by regular post or electronically via SFTP. Paper/PDF coupons have the following requirements:

KID

Payee name

Payee account number

Payer account number

Amount limit

Notification preference (yes/no)

Must be in portrait layout with all information on one page

Mandates are created by the consumer either through the suppliers webpage, or supplier sends out papers to be filled in, or the consumer can create it in their nettbank after they payed the first invoice.

Note! As long as the consumer has an active mandate and e-invoice agreement, the invoice will always be the notification.

Mandates are shown in EUI and can be fetched through the API.

We fetch the mandates when avtalegiro is actived and then we updated mandates 4 times a day (poll for new ones, updated ones)

kid string account_number string notification boolean 1 - consumer wants to be notified of avtalegiro sends, 0 - consumer does not want notification status integer 1 - active, 0 - inactive updated_timestamp string

When a consumer creates a direct debit mandate in their bank, they choose if they want to get a notification on a coming direct debit action. They choose if that is enabled or disabled, not how to be notified. We do not support bank notification. We support eFaktura as first choice, then e-mail and print. eFaktura as notification we also need to find them in Y2A (later slides). eFaktura as notification is not possible to pay in bank, unless manually changing it.

POST /v1/services/atg https://swagger.maventa.com/?urls.primaryName=STAGE%20-%20AutoXChange%20API#/services/postV1ServicesAtg To create a new ATG agreement GET /v1/services/atg https://swagger.maventa.com/?urls.primaryName=STAGE%20-%20AutoXChange%20API#/services/getV1ServicesAtg PATCH /v1/services/atg/{account_number} https://swagger.maventa.com/?urls.primaryName=STAGE%20-%20AutoXChange%20API#/services/patchV1ServicesAtgAccountNumber to update existing ATG agreement GET /v1/services/atg/{account_number} https://swagger.maventa.com/?urls.primaryName=STAGE%20-%20AutoXChange%20API#/services/getV1ServicesAtgAccountNumber to fetch ATG agreement

GET /v1/services/atg/mandates https://swagger.maventa.com/?urls.primaryName=STAGE%20-%20AutoXChange%20API#/services/getV1ServicesAtgMandates to fetch mandates

When sending consumers invoices it is mandatory to specify the recipient_type as “consumer” on the sending API metadata. Recipient_type identifies that the invoice is going to the B2C route. If “consumer” is not specified, the invoice will go to the B2B route.

It is also recommended that integrators use the route_order when sending consumer invoices. Route_order specifies the available routes the supplier wants to use and the priority of those routes. If the route_order is empty or it is left out completely the invoice will go to the predefined default route order.

Default route order is the following:

| Route | route_order value | Note |

| Direct debit (AvtaleGiro) | netbank | Direct debit route is part of the default route order only if the direct debit is active on the supplier’s account |

| eFaktura to netbank | netbank | eFaktura and VIPPS |

| if email address is given on the invoice data or in sending API metadata | ||

| Print service does not need to be enabled separately on the supplier’s account, printing will work anyway |

Example of sending a consumer invoice to a defined route order:

{

{ "version":"1.1", "recipient_type": "consumer", "routing": { "route_order":["netbank", "email", "print"] } }

}

When sending B2C invoices, the print service doesn’t need to be enabled in the supplier’s Maventa account. The print route is automatically enabled if it’s specified in the route order or if the default route order settings are used. The printed invoice will always use the sender’s invoice image, if provided, regardless of the print settings.

In certain situations, companies may have a specific need to have the route order set per supplier account not per invoice. In such cases, Maventa can assist in making this change. Please reach out to the Maventa support for further information and guidance on how to proceed with this request.

Attachments are supported through Visma Document Hotel. Limitations are the same as for print. Maventa send a link to Visma Document Hotel where we show only PDFs. If the invoice contains other attachment formats like .png we do not pass these on to consumer.

When the main vendor agreement and direct debit agreement are both active, direct debit invoices can be sent.

Instead supplier creating the deduction file and sending it to MPS themselves, the supplier can send the invoice via Maventa and the deduction file is created automatically based on that data on the invoice. The notification (eFaktura, e-mail or print) is also handled and sent out by Maventa. Meaning the supplier does not have to relate to two different channels.

Prerequisites for the supplier:

Prerequisites for the consumer:

The direct debit route is the first option in our default route order if the supplier has the direct debit activated.

Prerequisites towards the direct debit invoice:

If above mentioned prerequisites are not met or MPS returns an error that the mandate is not active, invoice will go to the next possible route (eFaktura, or email/print).

Consumers have the option to receive notifications about upcoming direct debits when they enter into a direct debit agreement with their supplier. The notification will primarily be sent as an eFaktura if the consumer has activated eFaktura through JTTA. If eFaktura is not activated, the notification can be sent via email or in print. If the consumer does not want to receive notifications, Maventa will only send the invoice as a direct debit without notification.

It is also possible for the supplier to disable notifications if they choose to do so.

Notification via eFaktura

If the consumer has eFaktura activated through JTTA notification will always be sent to netbank. It will be shown as an invoice with a direct debit and will not be possible for the consumer to pay.

Notification via email

If the consumer wants to be notified, and does not have eFaktura active, then the notification will be sent as email as long as there is an address available. The text in the e-mail specifies that this is a direct debit agreement to eliminate the risk of it getting paid twice.

Notification via print

If the consumer wants to be notified, and does not have eFaktura or e-mail address given, then the notification will be sent to print. Maventa will add a cover sheet to the invoice where it specifies that this is a direct debit and should not be paid.

When the main vendor agreement is active the first invoice can be sent. In order to send an invoice as eFaktura the receiver must be registered in in the “Yes to all” registry with MPS (JTTA).

validation on eFaktura:

Due date validation. Has to be minimum three days before due date.

Payable amount must be postive amount.

Bank account is validated 11 digits and MOD 11.

KID validation 2-25 digits MOD 10 check.

API methods:

eFaktura means both sending to Netbank and Vipps as long as the consumer is part of the “Yes to all” registry (JTTA) and has not disabled receiving in their Vipps application. What is sent to netbank is also shown in the Vipps application. Invoice is visible, and it can be paid in both netbank or Vipps, but cannot be paid twice. It is not possible anymore to only receive in Vipps.

Requirements on consumer to receive an invoice in Vipps:

However the following scenarios need to be taken into account:

Status:

When sending an invoice to Vipps the invoice is then validated and been sent to the consumers application and is visible under the payment section in the application. This is done in about 15 minutes. Status with Vipps is then pending and status with Maventa is sent. Sent status is the final status of this invoice. There it will stay until 14 days after due date then it is removed from the application.

Explanations of the states in Vipps: https://github.com/vippsas/vipps-invoice-api/blob/master/vipps-invoice-api.md#detailed-information-about-invoice-states-and-transitions

Note: ERPs that use invoice_create method can not send invoices to VIPPS because the phone number could not be saved to Database

Maventa can route an invoice to the Digital Postkasse Innbygger (DPI), which is used only by municipalities (Visma Enterprise). When sending to DPI the payload must contain a social security number (personnummer) in a .aix file. The SSN will be used to check the consumer against the Kontakt og Reservasjonsregistret (KRR). In KRR the consumer has chosen if they want to receive invoices or not to their DPI account, and if that account is in either eBoks och DigiPost.

In order to send to DPI or send with SSN contact Maventa support.

Invoices to consumers can be sent through Maventa as e-invoices to the consumer’s netbank, Kivra or via email and print. Distribution to consumer’s netbank and Kivra is handled by our partner, InConx AB (former Compello), who acts as the Certified Technical Distributor (CTD), and fallback routes, email and print by Maventa.

In Sweden also companies can receives invoices through this channel as a company can have an SSN (social security number) as their organization number.

To activate the B2C it is is a simple process - all you need is an account number where payments will be received. The required consumer invoicing agreements are created automatically during activation, so your company will be assigned an FUI (Faktura Utställar Identitet) and an Agreement ID (Avtals-ID or Avtalsbankgironummer) without any additional steps.

If you already have an FUI and Agreement ID, you can provide them during activation, but it’s not mandatory.

FUI (Faktura Utställar Identitet) is a unique to each sender and it is formed by the following information:

Example of an FUI: 005560169095.00002222222.FSPA.SE

For one FUI the sender can have 99 account numbers

To obtain an FUI from your own bank, the process must be handled manually by visiting the bank in person. When setting up the agreement, it’s important that the bank specifies InConx AB as the CTD (Certifierad Teknisk Distributör). InConx AB is a certified technical distributor of e-invoices to banks, partnering with BGC, Nordea, and Swedbank to ensure a secure and high-quality service. This certification is renewed annually. After the agreement is finalized, the sender will receive an FUI (Faktura Utställar Identitet) and an Agreement ID (Avtals-ID or Avtalsbankgironummer).

Following information is needed to activate the service through Maventa. Activation can be done either through our UI or via the API:

Mandatory:

Optional:

In addition to the account details (and optionally the FUI and Agreement ID), Maventa will also forward the company’s name and business ID (BID) to our B2C partner. Note! The sender’s account name in Maventa must exactly match the name registered with Bolagsverket, as this will be verified during the activation process.

Once the information is submitted, InConx AB will initiate the activation of the FUI and establish the necessary connections with Bankgirocentralen (BGC), Nordea, and Swedbank, enabling the sender to deliver e-invoices directly to consumers’ online banks. These connections also allow access to all other banks through the central systems. A connection to Kivra is also created at this stage and becomes active once the bank connections are established. This activation process typically takes about one week.

When activation is complete, the sender can start sending invoices to consumers via banks and Kivra. At the same time, an onboarding page is created, allowing consumers to register themselves as recipients in their online banks.

If the sender already has an active FUI and consumer invoicing setup with another service provider but wishes to transition to Maventa, it is possible to transfer the FUI and all related FMIs. This transfer requires manual handling, so please contact our support team for assistance.

Activation timeline:

There need to be a connection created towards BGC, Nordea and Swedbank and we must receive the status back from all three banks and Kivra before the B2C service is active. This can take up to a week.

Note! In case the sender is also a customer of InExchange, prevent routing all sent invoices through InExchange setting needs to be turned on in order for our B2C solution to work. If the setting is not turned on all sent invoice will be forced through InExchange connection without even trying our B2C route. When the setting is on, Maventa will hande internal traffic, sending to Peppol, email and print routes addition to the B2C and also handles the billing of these actions

API methods

POST /v1/services/b2cse/agreement - Create B2CSE network registration request

GET /v1/services/b2cse/agreement - Get status of B2CSE network reqistration request

Once the B2C service is active, the sender will appear as a B2C invoicer in consumers’ online banks, allowing consumers to set up a consumer invoicing agreement with them. To do this, the consumer is guided to an onboarding page within their netbank, where they must complete a standardized form. This page is branded with the Visma logo by default. If customization is needed, please contact our support team.

After the consumer submits the agreement, a unique identifier called FMI (Faktura Mottagar Identitet) is created and stored by InConx AB. This FMI is essential for delivering e-invoices to the consumer’s bank. The consumer’s social security number (SSN), included on the invoice, is used to match and retrieve the FMI. At this time, Maventa does not support sending consumer e-invoices without an active FMI.

FMI is a unique ID to identify the consumer. It is stored in InConx AB side, and there is currently no lookup capabilities towards the consumer registry.

FMI is specified as following:

Examples from different banks:

Note! Receiving invoices on behalf of someone else is not supported in our B2C solution currently.

When B2C SE is activated, a connection to Kivra is automatically established. If no FMI (Faktura Mottagar Identitet) is found for the consumer based on the SSN provided on the invoice, the invoice will be routed to Kivra — provided the consumer has Kivra capabilities. No prior agreement between the sender and the consumer is required for Kivra delivery. A lookup is performed against Kivra’s consumer registry using the SSN from the invoice. If the consumer has an active Kivra account, the invoice is delivered there. If the Kivra route fails, the invoice is sent via the next available fallback channel, such as email or print.

Note! Currently it is not possible to only activate the Kivra without the bank capabilities. If there is a growing need for this, we can re-evaluate the solution.

Before sending invoices through our B2C solutions make sure the service is in active state and that the prevent routing all through InExchange setting is on (read more from activation).

Invoice Requirements for B2C Delivery

The SSN should be provided in the endpoint ID field in one of the following formats: YYYYMMDDnnnn or YYMMDDnnnn

<cac:AccountingCustomerParty>

<cac:Party>

<cbc:EndpointID schemeID="0007">201012081234</cbc:EndpointID>

<cac:PartyIdentification>

<cbc:ID schemeID="0007">201012081234</cbc:ID>

</cac:PartyIdentification>

When an invoice is sent from the ERP to Maventa, it follows this routing logic:

Internal Routing Check

The value in the endpoint ID (or customer’s business ID) field is checked against our internal system. If a match is found, the invoice is sent directly to the receiver within our internal network.

Peppol Routing Check

The value in the endpoint ID (or customer’s business ID) field is cross-referenced with the Peppol registry. If the receiver is listed in Peppol, the invoice is routed through Peppol.

Inexchange / Swedish operator network Routing Check

The value in the endpoint ID (or customer’s business ID) field is checked against the Inexchange address book and NEA registry. If the receiver is found, invoice is sent through that operator route.

EINVOICE_BANK_B2C_SECO - invoice send to consumer’s Netbank

EINVOICE_B2C_SECO_KIVRA - invoice send to consumer’s Kivra account

Send and receive electronic invoices and other trading documents in an international Peppol network.

Peppol eases the trade between suppliers and buyers by providing a standardised way for exchanging trading documents electronically within countries and cross-border. Sending and receiving between recipients takes place over Peppol Access Points that connect the buyers and suppliers to the network.

Maventa is one of the cerfified Peppol Access Points. This means that when you are integrated to Maventa you can easily provide connection to Peppol to your customers.

0192. For Norwegian company whose organisation number would be 123456789 Peppol address would be 0192:123456789APIs to use REST API - Invoices and other documents SOAP API - Enable/disable, invoices only

Note, that if the company is already registered to receive invoices or other document types through another Access Point than Maventa this registration needs to be removed by the old Access Point before Maventa can do the registration.

To create registration to Peppol

REST API Call POST /v1/company/profiles

INVOICE_AND_CREDIT_NOTEPEPPOL{

"profiles": [

"INVOICE_AND_CREDIT_NOTE"

],

"network": "PEPPOL"

}SOAP API Call enable_operator with enabled=true

INVOICE_AND_CREDIT_NOTEMaventa creates the registration with the following identifiers (schemes)

0192)0216)0007)0184)0106 or 9944 - depending which is used to register company account to Maventa)9930)0208)9931)If you want to register a participant outside of these countries or with a different identifier please contact Maventa.

REST API

REST API

To follow up when the registration has been succesfully completed you can register a webhook. Use the event type NETWORKS to get notification of all changes in the registration statuses.

To remove registration from Peppol network

REST API

SOAP API

enabled=falseINVOICE_AND_CREDIT_NOTEUse print service to print the invoice and deliver it by post to recipients who cannot receive electronic invoices. Define the settings based on your customer needs.

Print can be used as the option to deliver the invoice if the invoice is not possible to send as an e-invoice or email invoice.

The requirements to send the invoice by print are that:

See the used price list for print related transaction costs.

To be able to use the print as a delivery option for the invoices, the printing service needs to be activated separately for a company account. Activation can be done through the API or UI.

To activate the print service use API method PATCH /v1/company/setting. Under send_invoice_print block set the parameter enabled to true.

To disable the printing service set the enabled parameter to false.

To check if the printing is active (or disabled) use use GET /v1/company/settings. Under send_invoice_print block the parameter enabled tells if the service is active (true) or not active/disabled (false).

To activate the print service call API method configure_company and set parameter print_and_send_request to 1.

To disable the printing service set the print_and_send_request to 0.

To check if the printing service is active use Show_company_configuration method and parameter print_and_send_enabled (true / false)

Invoices sent via print service will by default use Maventa generated invoice image template. This template is optimized for effective handling and it fits perfectly to the envelope used by the printing service provider. Customers can customize the template by adding their company logo to the invoice template (via UI or API).

Examples of Maventa templates here.

There is also an option to use the customer’s own invoice image for all the prints or per invoice (via UI or API). A cover sheet with address details will be added by Maventa to all printed invoices with the customer’s own image enabled and the cover sheet is debited as an extra page. The reason for the cover sheet is to make sure that the address details fits to the envelope.

Prints are always double-sided if there is more than one page.

To add a logo for an invoice image template created by Maventa use PATCH /v1/company/setting and parameter logos . Note! Most image formats are supported but not PDF. JPEG or PNG is preferred. PNG with transparency is not supported.

To remove the uploaded logo use the same above mentioned method method but

To use your own image with all prints, use PATCH /v1/company/setting. Under send_invoice_print block set the parameter use_own_pdf to true. To stop using your own image, set the use_own_pdf parameter to false.

In case you want to enable/disable the use of own image per invoice, it can be done when using POST /v1/invoices for sending. There is a parameter called print_own_image inside the print_settings that can be used to enable (true) or disable (false) the use of own image. Using this parameter will override the defined company based print settings.

To add a logo for an invoice image template created by Maventa use update_logo API method

To remove the uploaded logo use remove_logo method

To use your own image with prints, use configure_company method and set parameter print_and_send_own_pdf to true.

Note that when using your own template you should be careful and take technical restrictions in consideration.

All files must be of PDF format (or have the same content requirements) for it to be printed correctly. That means that the file cannot contain dynamic components and that all fonts, images and others are included in the file (ie the files should be 100% “self-contained”). All new customers must test their PDF files (all variants of fonts, images, etc.) to verify that the PDFs can be handled. If the PDF contains graphics, such as logos, charts, and other images, they must be of good quality.

See below for country-specific configuration options and requirements:

If you use your own invoice image make sure to familiarize youself with the PDF layout rules by Posti.

Addition to Posti as the mail distributor, there is also Jakeluyhtiö Suomi Oy (JYS) which have few additions to the Posti rules. Difference is the tracking barcodes they print on the invoice image, see the JYS rules merged with the Posti ones.

There is also an option to exclude the cover sheet from the prints. In that case the sender is not only responsible for making sure their invoice image meets the layout rules but also to make sure to follow the position requirements for the receiver’s address details so that those fit perfectly to the envelopes used in Finland. Contact support to confirm your layout and to enable this setting.

There is a possibility for customers to choose if they want all their invoice images to be printed with colors or with black & white (via API or UI). The default setting is black & white. If the color printing is enabled, it will be billed based on the number of pages in a printed invoice, not based on the number of pages actually having colors.

Addition to company based setting there is also a possibility to choose the color option for a specific invoice in the sending API

To enable the color printing for all invoices sent from a company account use PATCH /v1/company/setting method. Under send_invoice_print block set the parameter color_scheme to COLORED. To use only black & white set the parameter color_schemeto BLACK_AND_WHITE.

To choose the color printing in sending use POST /v1/invoices method and set print_settings[color] to “true”.

To enable the color printing for all invoices sent from a company account use configure_company method and set print_and_send_color parameter to true.

Invoices that are sent to Maventa before 24:00 will get printed, processed and enveloped during that night and handed over to the mail distributor next morning. Production does not take place during the weekends and holidays.

Mail distributors will deliver invoices to the receivers according to the chosen letter class.

There are two letter class options available for Finnish companies to choose from when sending domestic letter, economy and priority. Priority is the default one. Letter class can be changed via API or UI. For foreign letters, only priority class is used.

To change the letter class use PATCH /v1/company/setting method. Under send_invoice_print block set the parameter letter_class to PRIORITY or ECONOMY

To choose the letter class in sending use POST /v1/invoices method and set print_settings[letter_class] to “economy” or “priority”.

You can change the letter class using configure_company method and print_and_send_letter_class (1 = Priority, 0 = Economy) parameter.

The Finnish printing service uses two different envelope sizes. A smaller C5 envelope is used when there are up to 9 sheets in the invoice printed. When invoice has more than 9 sheets a bigger, more expensive, C4 size envelope is used. There are different billing actions for these two cases. As all the printed invoices are double-sided there needs to be more than 18 pages on an invoice for it to be more than 9 sheets, and to use the C4 envelope. Note! If sender’s own invoice image is used, cover sheet added by us is calculated as one page.

Separate PDF attachments are printed with following rules:

Note! There is an extra charge per page printed.

By default the printing of attachments is disabled for Finnish companies. This settings can be changed via API or UI.

If you wish to enable the printing of attachments you can do it by calling PATCH /v1/company/setting method. Under send_invoice_print block set the parameter attachment_print to true. And to disable it again, set the parameter attachment_print to false

If you wish to disable it you can do it by calling configure_company method and setting the parameter print_attachments to false (true = enabled, false = disabled)

When this setting is turned on every invoice that is printed using our PDF-tempate is automatically accompanied with instruction page which explains how your customer can receive invoices electronically instead of paper. Instruction page is free of charge for you.

To use the automatic e-instruction page call PATCH /v1/company/setting method. Under send_invoice_print block set the parameter marketing_page to “true”

To use the automatic e-instructions page call configure_company method with parameter marketing_on_invoice = true

OmaPosti is an application that allows consumers to receive their letters electronically instead of in a paper form. In case a consumer invoice is going to print, our print service provider will do a look up towards the OmaPosti consumer registry. When a consumer has an active OmaPosti account and has not opted out of receiving digital letters from a sender in question (based on the Maventa account’s OVT code), the invoice will be redirected to the consumer’s OmaPosti account instead of being delivered as a paper document. However, if the consumer does not have an OmaPosti account, the invoice will be printed and sent as a paper letter to the consumer. To determine if a consumer has an OmaPosti account, a combination of their name and postal address or social security number is used for identification. It is good to keep in mind that while a social security number (ssn) can be used as an identifier, it is highly recommended not to include such sensitive information on invoices.

It is also possible for the sender to exclude an invoice from being sent through the OmaPosti route:

To prevent using OmaPosti route for an invoice use POST /v1/invoices method and set print_settings[prevent_digital_post] to “true”.

To prevent using OmaPosti route for an invoice use invoice_put_invoice_with_metadata method and set parameter prevent_digital_post to “true”.

In summary, OmaPosti provides a digital alternative for receiving letters, but the specific criteria mentioned above are used to determine whether an invoice should be sent electronically or as a physical document.

When customer’s own invoice image is used, a cover sheet with receiver’s address details is added by Maventa to all printed invoices and it is debited as an extra page. The reason for the cover sheet is to make sure that the address details fits to the envelope. If you use your own PDF-template familiarize yourself with the PDF layout rules provided by the printing service provider.

All invoices are printed as black & white.

Invoices that are sent to Maventa before 24:00 will get printed, processed and enveloped during that night and handed over to the mail distributor next morning. Production does not take place during the weekends and holidays. Mail distributors will deliver invoices to the receivers using Priority letter class.

Separate PDF attachments are printed with following rules:

Note! There is an extra charge per page printed.

By default the printing of attachments is enabled for Norwegian companies. This settings can be changed via API or UI.

The Return Post Automation feature, available in Norway, helps handle undeliverable printed invoices such as those sent to outdated or incorrect addresses, by redirecting them to a designated return address instead of sending them back to the original sender. This return address is automatically used as the sender address on the letters and added by Maventa. At the return address, the sender’s information is extracted, the physical letter is securely shredded, and the delivery failure is reported back to Maventa. The related invoice is then marked with a delivery error.

This provides the sender with a clear overview of failed letters, making it easier to update customer information and resend the invoice if necessary.

This feature comes with a small fee.

If you wish to disable the printing of attachments you can do it by calling PATCH /v1/company/setting method. Under send_invoice_print block set the parameter attachment_print to false. And to enable it again, set the parameter attachment_print to true

If you wish to disable it you can do it by calling configure_company method and setting the parameter print_attachments to false (true = enabled, false = disabled).

When customer’s own invoice image is used, a cover sheet with receiver’s address details is added by Maventa to all printed invoices and it is debited as an extra page. The reason for the cover sheet is to make sure that the address details fits to the envelope. See the PDF layout rules provided by the printing service provider.

The Swedish printing service uses two different envelope sizes. A smaller C5 envelope is used when there are up to 6 sheets in the invoice printed. When invoice has more than 6 sheets a bigger, more expensive, C4 size envelope is used. There are different billing actions for these two cases. As all the printed invoices are double-sided there needs to be more than 12 pages on an invoice for it to be more than 6 sheets, and to use the C4 envelope. Note! If sender’s own invoice image is used, cover sheet is calculated as one page.

There is a possibility for customers to choose if they want all their invoice images to be printed with colors or with black & white (via API or UI). The default setting is black & white. If the color printing is enabled, it will be billed based on the number of pages in a printed invoice, not based on the number of pages actually having colors.

Addition to company based setting there is also a possibility to choose the color option for a specific invoice in the sending API.

To enable the color printing for all the invoice sent from the company account use PATCH /v1/company/setting method. Under send_invoice_print block set the parameter color_scheme to COLORED. To use only black & white set the parameter color_schemeto BLACK_AND_WHITE.

To choose the color printing in sending use POST /v1/invoices method and set print_settings[color] to “true”.

To enable the color printing use configure_company method and set print_and_send_color parameter to true.

Separate PDF attachments are printed with following rules:

If attachments exceed these limits, all the attachments are dropped and the sender will be notified via email. Invoice image is still printed.

Note! There is an extra charge per page printed.

By default the printing of attachments is enabled for Swedish companies. This settings can be changed via API or UI.

If you wish to disable the printing of attachments you can do it by calling PATCH /v1/company/setting method. Under send_invoice_print block set the parameter attachment_print to false. And to enable it again, set the parameter attachment_print to true

If you wish to disable the printing of attachments you can do it by calling configure_company method and setting the parameter print_attachments to false (true = enabled, false = disabled).

Invoices that are sent to AutoInvoice before 24:00 on workdays will get printed, enveloped and handed over to the mail distributor the next day. Production does not take place during the weekends and holidays. Mail distributors will deliver invoices to the receivers according to the chosen letter class. There are two letter class options available for Swedish companies, economy (B-post) and priority (A-post). Priority is the default value. (via UI or API). See the delivery schedule

To change the letter class use PATCH /v1/company/setting method. Under send_invoice_print block set the parameter letter_class to PRIORITY or ECONOMY

To choose the letter class in sending use POST /v1/invoices method and set print_settings[letter_class] to “economy” or “priority”.

You can change the letter class using configure_company method and print_and_send_letter_class (1 = Priority, 0 = Economy) parameter.