Attachments and invoice image

When sending e-invoices, a PDF version of the invoice is always sent, except in Peppol. It is expected that ERP generates and sends the invoice image in PDF format along with the XML. In that way the user can have better overview of the PDF view of the invoice.

The invoice image and attachments can be embedded within XML or sent within a zip with the XML itself, depending on the invoice format that is used.

If the invoice image is sent as an attachment within a zip file, the invoice XML and invoice image in the zip needs to be named the same way for Maventa to recognize the attachment as the invoice image. For example 12345.xml and 12345.pdf. Name of the other attachments doesn’t need to match with the XML file.

Attachment (image or other) size is maximum 10 Mb per file. Server limit for the whole package is 150 Mb. It is not recommended to use big attachments. Smaller the better.

You cannot send attachments inside a zip file if you use a format that supports embedding (eg: Peppol BIS 3.0, OIOUBL 2.1). Any extra files will be skipped from the zip file.

In case PDF invoice image is not provided, a general invoice image will be created by Maventa based on the original XML invoice, using the Maventa PDF templates. The purpose of PDF templates is to provide bare minimum substitution of missing PDF invoice image, in order to avoid stopping the invoice sending process.

Maventa PDF templates include the core invoice content. This substitution PDF invoice image might not satisfy everyone’s needs, therefore it is recommended that the ERP provide own PDF invoice image along with the XML, especially when special content contrsuction or specific design of invoice image is needed.

In Maventa there are two different general templates in use, depending on market area / country where the invoice is sent to. Belowe you can find the examples.

The design of the general templates may change at time, however keeping all the existing document data in it.

Supported attachment filetypes

- .tif

- .tiff

- .jpg

- .jpeg

- .png

- .gif

- .txt

- .xml

- .xls

- .xsl

- .xlsx

- .html

- .htm

- .pdf - RECOMMENDED

- .aix

- .doc

- .docx

- .ods

These are the attachment types supported by Maventa SOAP and REST API.

Note that there might be also format and operator specific limitations. Remember check limitations from format’s documentation, e.g. PEPPOL support only these MimeCodes.

Examples

Example XML files have tag names as values to make make it clear where they will be visualised in the PDFs. Note that if all the address details are given the PDF will easily expand to two or more pages.

Finvoice

The following example PDF is generated when invoice is sent in Finnish market, and the XML is in Finvoice 3.0 format.

The following example PDF is generated when invoice is sent in other markets, and the XML is in Finvoice 3.0 format.

Example Finvoice 3.0 XML of above visualisations

<?xml version="1.0" encoding="ISO-8859-15"?>

<?xml-stylesheet type="text/xsl" href="Finvoice.xsl"?>

<Finvoice Version="3.0"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<SellerPartyDetails>

<SellerPartyIdentifier>1234567-8</SellerPartyIdentifier>

<SellerOrganisationName>SellerOrganisationName</SellerOrganisationName>

<SellerOrganisationTaxCode>FI12345678</SellerOrganisationTaxCode>

<SellerOrganisationTaxCodeUrlText>http://ec.europa.eu/taxation_customs/vies/vieshome.do</SellerOrganisationTaxCodeUrlText>

<SellerPostalAddressDetails>

<SellerStreetName>SellerStreetName</SellerStreetName>

<SellerTownName>SellerTownName</SellerTownName>

<SellerPostCodeIdentifier>SellerPostCodeIdentifier</SellerPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>CountryName</CountryName>

<SellerPostOfficeBoxIdentifier>SellerPostOfficeBoxIdentifier</SellerPostOfficeBoxIdentifier>

</SellerPostalAddressDetails>

</SellerPartyDetails>

<SellerCommunicationDetails>

<SellerPhoneNumberIdentifier>SellerPhoneNumberIdentifier</SellerPhoneNumberIdentifier>

<SellerEmailaddressIdentifier>SellerEmailaddressIdentifier</SellerEmailaddressIdentifier>

</SellerCommunicationDetails>

<SellerInformationDetails>

<SellerHomeTownName>SellerHomeTownName</SellerHomeTownName>

<SellerPhoneNumber>SellerPhoneNumber</SellerPhoneNumber>

<SellerFaxNumber>SellerFaxNumber</SellerFaxNumber>

<SellerWebaddressIdentifier>SellerWebaddressIdentifier</SellerWebaddressIdentifier>

<!-- If bank details given here they override details given in EpiPartyDetails on PDF creation -->

<!--SellerAccountDetails>

<SellerAccountID IdentificationSchemeName="IBAN">SellerAccountID</SellerAccountID>

<SellerBic IdentificationSchemeName="BIC">SellerBic</SellerBic>

<SellerAccountName>SellerAccountName</SellerAccountName>

</SellerAccountDetails-->

</SellerInformationDetails>

<InvoiceRecipientPartyDetails>

<InvoiceRecipientPartyIdentifier>7654321-8</InvoiceRecipientPartyIdentifier>

<InvoiceRecipientOrganisationName>InvoiceRecipientOrganisationName</InvoiceRecipientOrganisationName>

<InvoiceRecipientPostalAddressDetails>

<InvoiceRecipientStreetName>InvoiceRecipientStreetName</InvoiceRecipientStreetName>

<InvoiceRecipientStreetName>InvoiceRecipientStreetName2</InvoiceRecipientStreetName>

<InvoiceRecipientTownName>InvoiceRecipientTownName</InvoiceRecipientTownName>

<InvoiceRecipientPostCodeIdentifier>InvoiceRecipientPostCodeIdentifier</InvoiceRecipientPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>CountryName</CountryName>

</InvoiceRecipientPostalAddressDetails>

</InvoiceRecipientPartyDetails>

<InvoiceRecipientLanguageCode>EN</InvoiceRecipientLanguageCode>

<BuyerPartyDetails>

<BuyerPartyIdentifier>7894561-2</BuyerPartyIdentifier>

<BuyerOrganisationName>BuyerOrganisationName</BuyerOrganisationName>

<BuyerOrganisationTaxCode>FI78945612</BuyerOrganisationTaxCode>

<BuyerPostalAddressDetails>

<BuyerStreetName>BuyerStreetName</BuyerStreetName>

<BuyerStreetName>BuyerStreetName2</BuyerStreetName>

<BuyerTownName>BuyerTownName</BuyerTownName>

<BuyerPostCodeIdentifier>BuyerPostCodeIdentifier</BuyerPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>CountryName</CountryName>

</BuyerPostalAddressDetails>

</BuyerPartyDetails>

<BuyerContactPersonName>BuyerContactPersonName</BuyerContactPersonName>

<DeliveryPartyDetails>

<DeliveryOrganisationName>DeliveryOrganisationName</DeliveryOrganisationName>

<DeliveryPostalAddressDetails>

<DeliveryStreetName>DeliveryStreetName</DeliveryStreetName>

<DeliveryTownName>DeliveryTownName</DeliveryTownName>

<DeliveryPostCodeIdentifier>DeliveryPostCodeIdentifier</DeliveryPostCodeIdentifier>

</DeliveryPostalAddressDetails>

</DeliveryPartyDetails>

<DeliveryDetails>

<DeliveryDate Format="CCYYMMDD">20200501</DeliveryDate>

<DeliveryTermsText>DeliveryTermsText</DeliveryTermsText>

<DeliveryNoteIdentifier>DeliveryNoteIdentifier</DeliveryNoteIdentifier>

</DeliveryDetails>

<InvoiceDetails>

<InvoiceTypeCode CodeListAgencyIdentifier="SPY">INV01</InvoiceTypeCode>

<InvoiceTypeCodeUN>380</InvoiceTypeCodeUN>

<InvoiceTypeText>LASKU</InvoiceTypeText>

<OriginCode>Original</OriginCode>

<InvoiceNumber>InvoiceNumber</InvoiceNumber>

<InvoiceDate Format="CCYYMMDD">20200101</InvoiceDate>

<OriginalInvoiceNumber>Orig.Inv.Number</OriginalInvoiceNumber>

<InvoicingPeriodStartDate Format="CCYYMMDD">20200101</InvoicingPeriodStartDate>

<InvoicingPeriodEndDate Format="CCYYMMDD">20201231</InvoicingPeriodEndDate>

<SellerReferenceIdentifier>SellerReferenceIdentifier</SellerReferenceIdentifier>

<SellersBuyerIdentifier>SellersBuyerIdentifier</SellersBuyerIdentifier>

<OrderIdentifier>OrderIdentifier</OrderIdentifier>

<AgreementIdentifier>AgreementIdentifier</AgreementIdentifier>

<BuyerReferenceIdentifier>BuyerReferenceIdentifier</BuyerReferenceIdentifier>

<RowsTotalVatExcludedAmount AmountCurrencyIdentifier="EUR">100,00</RowsTotalVatExcludedAmount>

<InvoiceTotalVatExcludedAmount AmountCurrencyIdentifier="EUR">100,00</InvoiceTotalVatExcludedAmount>

<InvoiceTotalVatAmount AmountCurrencyIdentifier="EUR">24,00</InvoiceTotalVatAmount>

<InvoiceTotalVatIncludedAmount AmountCurrencyIdentifier="EUR">124,00</InvoiceTotalVatIncludedAmount>

<VatSpecificationDetails>

<VatBaseAmount AmountCurrencyIdentifier="EUR">100,00</VatBaseAmount>

<VatRatePercent>24</VatRatePercent>

<VatCode>S</VatCode>

<VatRateAmount AmountCurrencyIdentifier="EUR">24</VatRateAmount>

</VatSpecificationDetails>

<InvoiceFreeText>InvoiceFreeText</InvoiceFreeText>

<PaymentTermsDetails>

<PaymentTermsFreeText>PaymentTermsFreeText</PaymentTermsFreeText>

<InvoiceDueDate Format="CCYYMMDD">20201201</InvoiceDueDate>

<PaymentOverDueFineDetails>

<PaymentOverDueFinePercent>14</PaymentOverDueFinePercent>

</PaymentOverDueFineDetails>

</PaymentTermsDetails>

</InvoiceDetails>

<FactoringAgreementDetails>

<FactoringAgreementIdentifier>FactoringAgreementIdentifier</FactoringAgreementIdentifier>

<EndorsementClauseCode>F</EndorsementClauseCode>

<FactoringFreeText>FactoringFreeText</FactoringFreeText>

<FactoringFreeText>FactoringFreeText</FactoringFreeText>

<FactoringPartyIdentifier>3216549-8</FactoringPartyIdentifier>

<FactoringPartyName>FactoringPartyName</FactoringPartyName>

<FactoringPartyPostalAddressDetails>

<FactoringPartyStreetName>FactoringPartyStreetName</FactoringPartyStreetName>

<FactoringPartyTownName>FactoringPartyTownName</FactoringPartyTownName>

<FactoringPartyPostCodeIdentifier>FactoringPartyPostCodeIdentifier</FactoringPartyPostCodeIdentifier>

<CountryCode>FI</CountryCode>

<CountryName>Suomi</CountryName>

</FactoringPartyPostalAddressDetails>

</FactoringAgreementDetails>

<VirtualBankBarcode>423571690200529290000246000000000000329041884403200320</VirtualBankBarcode>

<InvoiceRow>

<ArticleIdentifier>ArticleIdentifier</ArticleIdentifier>

<ArticleName>ArticleName</ArticleName>

<DeliveredQuantity QuantityUnitCode="kpl">1,00</DeliveredQuantity>

<OrderedQuantity QuantityUnitCode="kpl">1,00</OrderedQuantity>

<InvoicedQuantity QuantityUnitCode="kpl">1,00</InvoicedQuantity>

<UnitPriceAmount UnitPriceUnitCode="kpl" AmountCurrencyIdentifier="EUR">200,00</UnitPriceAmount>

<UnitPriceNetAmount AmountCurrencyIdentifier="EUR">100,00</UnitPriceNetAmount>

<RowIdentifier>RowIdentifier</RowIdentifier>

<RowOrderPositionIdentifier>1</RowOrderPositionIdentifier>

<RowPositionIdentifier>1</RowPositionIdentifier>

<RowDeliveryDate Format="CCYYMMDD">20200515</RowDeliveryDate>

<RowBuyerReferenceIdentifier>RowBuyerReferenceIdentifier</RowBuyerReferenceIdentifier>

<RowFreeText>RowFreeText</RowFreeText>

<RowDiscountPercent>50,0</RowDiscountPercent>

<RowDiscountAmount AmountCurrencyIdentifier="EUR">100,00</RowDiscountAmount>

<RowDiscountTypeText>RowDiscountTypeText</RowDiscountTypeText>

<RowVatRatePercent>24,0</RowVatRatePercent>

<RowVatCode>S</RowVatCode>

<RowVatAmount AmountCurrencyIdentifier="EUR">24</RowVatAmount>

<RowVatExcludedAmount AmountCurrencyIdentifier="EUR">100,00</RowVatExcludedAmount>

<RowAmount AmountCurrencyIdentifier="EUR">124,00</RowAmount>

</InvoiceRow>

<SpecificationDetails>

<SpecificationFreeText>SpecificationFreeText</SpecificationFreeText>

</SpecificationDetails>

<EpiDetails>

<EpiIdentificationDetails>

<EpiDate Format="CCYYMMDD">20200101</EpiDate>

<EpiReference>EpiReference</EpiReference>

</EpiIdentificationDetails>

<EpiPartyDetails>

<EpiBfiPartyDetails>

<EpiBfiIdentifier IdentificationSchemeName="BIC">EpiBfiID</EpiBfiIdentifier>

<EpiBfiName>EpiBfiName</EpiBfiName>

</EpiBfiPartyDetails>

<EpiBeneficiaryPartyDetails>

<EpiNameAddressDetails>EpiNameAddressDetails</EpiNameAddressDetails>

<EpiBei>1234567-8</EpiBei>

<EpiAccountID IdentificationSchemeName="IBAN">EpiAccountID</EpiAccountID>

</EpiBeneficiaryPartyDetails>

</EpiPartyDetails>

<EpiPaymentInstructionDetails>

<EpiPaymentInstructionId/>

<!-- Used to identify invoice as B2C invoice -->

<EpiRemittanceInfoIdentifier IdentificationSchemeName="ISO">0123456789</EpiRemittanceInfoIdentifier>

<EpiInstructedAmount AmountCurrencyIdentifier="EUR">124,00</EpiInstructedAmount>

<EpiCharge ChargeOption="SHA">SHA</EpiCharge>

<EpiDateOptionDate Format="CCYYMMDD">20201201</EpiDateOptionDate>

</EpiPaymentInstructionDetails>

</EpiDetails>

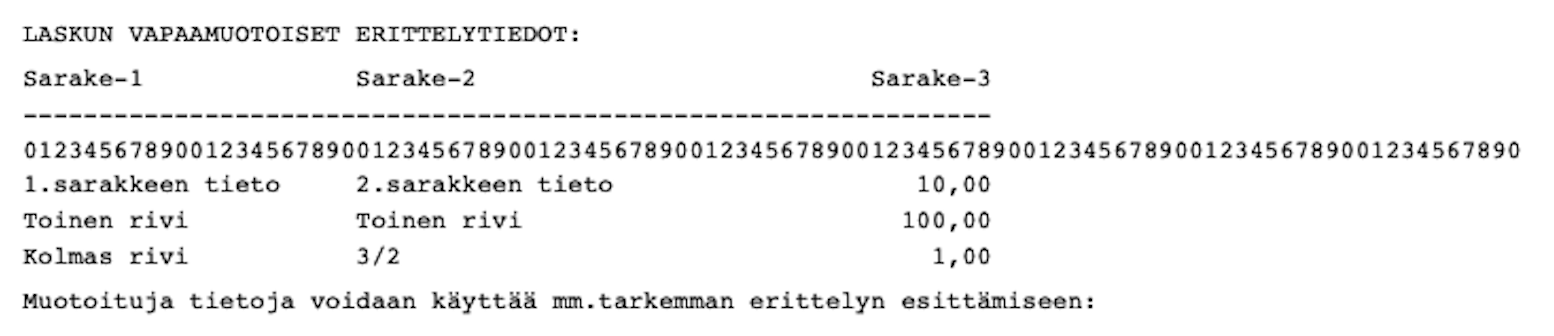

</Finvoice>Finnish market example has <SpecificationDetails> -element given (<SpecificationFreeText> tags). That element has different font and styling. The font is Courier (all the characters are equally wide). The purpose of using this font type in this case is to keep the formatted text as it is given in the XML.

Example usage of <SpecificationDetails> -element and how it would look like in the PDF

<SpecificationDetails>

<SpecificationFreeText>LASKUN VAPAAMUOTOISET ERITTELYTIEDOT:</SpecificationFreeText>

<SpecificationFreeText>Sarake-1 Sarake-2 Sarake-3</SpecificationFreeText>

<SpecificationFreeText>---------------------------------------------------------------------------------------------------</SpecificationFreeText>

<SpecificationFreeText>1.sarakkeen tieto 2.sarakkeen tieto 10,00</SpecificationFreeText>

<SpecificationFreeText>Toinen rivi Toinen rivi 1 000,00</SpecificationFreeText>

<SpecificationFreeText>Kolmas rivi 3/2 1,00</SpecificationFreeText>

<SpecificationFreeText>Muotoituja tietoja voidaan käyttää mm.tarkemman erittelyn esittämiseen:</SpecificationFreeText>

</SpecificationDetails>

TEAPPSXML

The following example PDF is generated when invoice is sent in Finnish market, and the XML is in TEAPPSXML 3.0 format.

The following example PDF is generated when invoice is sent in other markets, and the XML is in TEAPPSXML 3.0 format.

Example TEAPPSXML 3.0 XML of above visualisations

<?xml version="1.0" encoding="ISO-8859-1"?>

<INVOICE_CENTER>

<TRANSPORT_FRAME>

<TF_CODE>TF01</TF_CODE>

<TIMESTAMP>20120530220324800</TIMESTAMP>

<BATCH_ID>87654321</BATCH_ID>

<CONTENT_RECEIVER>

<RECEIVER_REF>ID003712345671</RECEIVER_REF>

<CONTENT_REF>12151867</CONTENT_REF>

</CONTENT_RECEIVER>

<SENDER>TE003712345671IC</SENDER>

<FB_REQUEST>1</FB_REQUEST>

</TRANSPORT_FRAME>

<CONTENT_FRAME>

<CF_CODE>CF01</CF_CODE>

<NET_SERVICE_ID>TE003712345671IC</NET_SERVICE_ID>

<BLOCK_ID>87654321</BLOCK_ID>

<TIMESTAMP>20120530220324800</TIMESTAMP>

<BLOCK_RULES>

<TRANSACTION_TYPE>00</TRANSACTION_TYPE>

<BLOCK_ACTION>00</BLOCK_ACTION>

<BLOCK_FORMAT>TEAPPSXML</BLOCK_FORMAT>

<FORMAT_VERSION>3.0</FORMAT_VERSION>

<CHARACTER_SET>ISO-8859-1</CHARACTER_SET>

</BLOCK_RULES>

<INVOICES>

<INVOICE>

<HEADER>

<INVOICE_ID>123456789123</INVOICE_ID>

<PROCESS_CODE>00</PROCESS_CODE>

<INVOICE_TYPE>00</INVOICE_TYPE>

<SUBJECT>LASKU</SUBJECT>

<INVOICE_DATE>

<DATE>

<DAY>30</DAY>

<MONTH>11</MONTH>

<CENTURY>20</CENTURY>

<DECADE_AND_YEAR>21</DECADE_AND_YEAR>

</DATE>

</INVOICE_DATE>

<DUE_DATE>

<DATE>

<DAY>01</DAY>

<MONTH>01</MONTH>

<CENTURY>20</CENTURY>

<DECADE_AND_YEAR>22</DECADE_AND_YEAR>

</DATE>

</DUE_DATE>

<REMARK_TIME>8 pv</REMARK_TIME>

<DELIVERY_DATE>

<DATE>

<DAY>31</DAY>

<MONTH>12</MONTH>

<CENTURY>20</CENTURY>

<DECADE_AND_YEAR>21</DECADE_AND_YEAR>

</DATE>

</DELIVERY_DATE>

<TERMS_OF_DELIVERY>TERMS_OF_DELIVERY</TERMS_OF_DELIVERY>

<TERMS_OF_PAYMENT>TERMS_OF_PAYMENT</TERMS_OF_PAYMENT>

<PAYMENT_OVERDUE_FINE>

<INTEREST_RATE>14.00</INTEREST_RATE>

<SURCHARGE>

<AMOUNT SIGN="+" VAT="EXCLUDED">15.00</AMOUNT>

</SURCHARGE>

<FREE_TEXT>PAYMENT_OVERDUE_FINE_FREE_TEXT</FREE_TEXT>

</PAYMENT_OVERDUE_FINE>

<CURRENCY>

<CODE>EUR</CODE>

</CURRENCY>

<PAYMENT_INSTRUCTION_IDENTIFIER>89</PAYMENT_INSTRUCTION_IDENTIFIER>

<ORDER_REFERENCE/>

<ORDER_INFORMATION ORDER_TYPE="VN">

<ORDER_NUMBER>Viitteemme KUITTI 001 - 01 - 123456</ORDER_NUMBER>

</ORDER_INFORMATION>

<ORDER_INFORMATION ORDER_TYPE="CO">

<ORDER_NUMBER>ORDER_INFO/ORDER_NUMBER</ORDER_NUMBER>

<ORDER_REFERENCE>OTTO OSTAJA</ORDER_REFERENCE>

</ORDER_INFORMATION>

<CONTRACT_INFORMATION>

<CONTRACT_NUMBER>CONTRACT_NUMBER</CONTRACT_NUMBER>

</CONTRACT_INFORMATION>

<PROJECT_INFORMATION PROJECT_TYPE="PROJECT_TYPE">

<PROJECT_NUMBER>1234567890</PROJECT_NUMBER>

<PROJECT_TITLE>PROJECT_TITLE</PROJECT_TITLE>

<FREE_TEXT TEXT_TYPE="TEXT_TYPE">FREE_TEXT</FREE_TEXT>

</PROJECT_INFORMATION>

<TRANSPORT_INFORMATION>

<MODE_OF_TRANSPORT>TRANSPORT_INFORMATION/MODE_OF_TRANSPORT</MODE_OF_TRANSPORT>

<FINAL_DESTINATION SCHEME_ID="0037">003712345671</FINAL_DESTINATION>

</TRANSPORT_INFORMATION>

<PAYER_POSTING_GROUP_DEFAULTS>

<POSTING_DEFAULT>

<ACCOUNT>POSTING_DEFAULT/ACCOUNT</ACCOUNT>

<SHORT_ACCOUNT_ID>1234</SHORT_ACCOUNT_ID>

<NORMAL_ACCOUNT_ID>1234</NORMAL_ACCOUNT_ID>

<DIMENSIONS>

<DIMENSION>

<DIMENSION_VALUE>DIMENSIONS/DIMENSION/DIMENSION_VALUE</DIMENSION_VALUE>

</DIMENSION>

</DIMENSIONS>

<ACCOUNT_REFERENCE>POSTING_DEFAULT/ACCOUNT_REFERENCE</ACCOUNT_REFERENCE>

<REPORTING_CODE>POSTING_DEFAULT/REPORTING_CODE</REPORTING_CODE>

</POSTING_DEFAULT>

</PAYER_POSTING_GROUP_DEFAULTS>

<SELLER_ACCOUNT_TEXT>SELLER_ACCOUNT_TEXT</SELLER_ACCOUNT_TEXT>

<INVOICE_ORDER_NUMBER>INVOICE_ORDER_NUMBER</INVOICE_ORDER_NUMBER>

<BUYER_REFERENCE>BUYER_REFERENCE</BUYER_REFERENCE>

<DELIVERER_REFERENCE>DELIVERER_REFERENCE</DELIVERER_REFERENCE>

<OFFER_REFERENCE>OFFER_REFERENCE</OFFER_REFERENCE>

<INVOICED_OBJECT SCHEME_ID="ABT">ID1234</INVOICED_OBJECT>

<SECURITY_DETAILS>

<SECRECY_CLASS>SECRECY_CLASS</SECRECY_CLASS>

<SECRECY_DESCRIPTION>SECRECY_DESCRIPTION</SECRECY_DESCRIPTION>

</SECURITY_DETAILS>

<PAYMENT_CARD_INFORMATION>

<PRIMARY_ACCOUNT_NUMBER>1234</PRIMARY_ACCOUNT_NUMBER>

<PAYMENT_CARD_HOLDER>PAYMENT_CARD_HOLDER</PAYMENT_CARD_HOLDER>

</PAYMENT_CARD_INFORMATION>

<FREE_TEXT>INVOICE HEADER FREE_TEXT</FREE_TEXT>

</HEADER>

<INVOICE_SENDER>

<CUSTOMER_INFORMATION>

<CUSTOMER_NAME>INVOICE_SENDER/CUSTOMER_NAME</CUSTOMER_NAME>

<CUSTOMER_ID SCHEME_ID="0037">003766666630</CUSTOMER_ID>

<ADDRESS>

<STREET_ADDRESS1>INVOICE_SENDER/STREET_ADDRESS1</STREET_ADDRESS1>

<SUBDIVISION>INVOICE_SENDER/SUBDIVISION</SUBDIVISION>

<POSTAL_CODE>INVOICE_SENDER/POSTAL_CODE</POSTAL_CODE>

<POST_OFFICE>INVOICE_SENDER/POST_OFFICE</POST_OFFICE>

<COUNTRY>Finland</COUNTRY>

<COUNTRY_CODE>FI</COUNTRY_CODE>

</ADDRESS>

<TRADING_NAME>INVOICE_SENDER/TRADING_NAME</TRADING_NAME>

<VAT_REG>Registration pending</VAT_REG>

<VAT_NUMBER>FI66666614</VAT_NUMBER>

<ORGANIZATION_NUMBER>6666661-4</ORGANIZATION_NUMBER>

<PARTY_IDENTIFICATION_ID AUTHORITY="EDI" SCHEME_ID="0037">003766666622</PARTY_IDENTIFICATION_ID>

<TRADE_REGISTRY_NUMBER>666</TRADE_REGISTRY_NUMBER>

<SITE>6666</SITE>

<ORGANIZATION_DEPARTMENT>INVOICE_SENDER/</ORGANIZATION_DEPARTMENT>

<CONTACT_INFORMATION>

<CONTACT_PERSON>INVOICE_SENDER/CONTACT_PERSON</CONTACT_PERSON>

<CONTACT_PERSON_FUNCTION>INVOICE_SENDER/CONTACT_PERSON_FUNCTION</CONTACT_PERSON_FUNCTION>

<DEPARTMENT>INVOICE_SENDER/CONTACT_PERSON_DEPARTMENT</DEPARTMENT>

<TELEPHONE_NUMBER>040 6666 666</TELEPHONE_NUMBER>

<TELEFAX_NUMBER>09-6666 666</TELEFAX_NUMBER>

<E-MAIL_ADDRESS>email@invoice_sender.com</E-MAIL_ADDRESS>

</CONTACT_INFORMATION>

<LANGUAGE_CODE>FI</LANGUAGE_CODE>

<NOTE>Note</NOTE>

<FREE_TEXT TEXT_TYPE="TextType">FREE_TEXT</FREE_TEXT>

</CUSTOMER_INFORMATION>

</INVOICE_SENDER>

<PAYEE>

<CUSTOMER_INFORMATION>

<CUSTOMER_NAME>PAYEE/CUSTOMER_NAME1</CUSTOMER_NAME>

<CUSTOMER_NAME>PAYEE/CUSTOMER_NAME2</CUSTOMER_NAME>

<CUSTOMER_ID SCHEME_ID="0037">003711111136</CUSTOMER_ID>

<ADDRESS>

<STREET_ADDRESS1>STREET_ADDRESS1</STREET_ADDRESS1>

<SUBDIVISION>SUBDIVISION</SUBDIVISION>

<POSTAL_CODE>POSTAL_CODE</POSTAL_CODE>

<POST_OFFICE>POST_OFFICE</POST_OFFICE>

<COUNTRY>Finland</COUNTRY>

<COUNTRY_CODE>FI</COUNTRY_CODE>

</ADDRESS>

<TRADING_NAME>PAYEE/TRADING_NAME</TRADING_NAME>

<VAT_REG>Registration pending</VAT_REG>

<VAT_NUMBER>FI11111111</VAT_NUMBER>

<ORGANIZATION_NUMBER>1111111-1</ORGANIZATION_NUMBER>

<PARTY_IDENTIFICATION_ID AUTHORITY="EDI" SCHEME_ID="0037">003711111128</PARTY_IDENTIFICATION_ID>

<TRADE_REGISTRY_NUMBER>111</TRADE_REGISTRY_NUMBER>

<SITE>1111</SITE>

<ORGANIZATION_DEPARTMENT>ORGANIZATION_DEPARTMENT1</ORGANIZATION_DEPARTMENT>

<ORGANIZATION_DEPARTMENT>ORGANIZATION_DEPARTMENT2</ORGANIZATION_DEPARTMENT>

<CONTACT_INFORMATION>

<CONTACT_PERSON>PAYEE/CONTACT_PERSON</CONTACT_PERSON>

<CONTACT_PERSON_FUNCTION>PAYEE/CONTACT_PERSON_FUNCTION</CONTACT_PERSON_FUNCTION>

<DEPARTMENT>PAYEE/DEPARTMENT</DEPARTMENT>

<TELEPHONE_NUMBER>PAYEE/TELEPHONE_NUMBER</TELEPHONE_NUMBER>

<TELEFAX_NUMBER>09-1111 111</TELEFAX_NUMBER>

<E-MAIL_ADDRESS>PAYEE/EMAIL_ADDRESS</E-MAIL_ADDRESS>

</CONTACT_INFORMATION>

<LANGUAGE_CODE>FI</LANGUAGE_CODE>

<NOTE>Note</NOTE>

<FREE_TEXT TEXT_TYPE="TextType">PAYEE/FREE_TEXT</FREE_TEXT>

</CUSTOMER_INFORMATION>

<BANKS>

<BANK_NAME>OP</BANK_NAME>

<BANK_ACCOUNT_NUMBER>500015-281</BANK_ACCOUNT_NUMBER>

<SWIFT_CODE>OKOYFIHH</SWIFT_CODE>

<IBAN_ACCOUNT_NUMBER>FI1350001520000081</IBAN_ACCOUNT_NUMBER>

</BANKS>

<BANKS>

<BANK_NAME>Nordea</BANK_NAME>

<BANK_ACCOUNT_NUMBER>123456-000785</BANK_ACCOUNT_NUMBER>

<SWIFT_CODE>NDEAFIHH</SWIFT_CODE>

<IBAN_ACCOUNT_NUMBER>FI2112345600000785</IBAN_ACCOUNT_NUMBER>

</BANKS>

<NET_SERVICE_ID>003711111101</NET_SERVICE_ID>

<INTERMEDIATOR>PAYEE/INTERMEDIATOR</INTERMEDIATOR>

<EADDRESS_SCHEME_ID_CODE>0037</EADDRESS_SCHEME_ID_CODE>

<PRELIMINARY_TAX_REGISTERED>alv.rek</PRELIMINARY_TAX_REGISTERED>

<ADDITIONAL_LEGAL_INFO>Share capital</ADDITIONAL_LEGAL_INFO>

<PAYEE_REFERENCE>Basware Oyj</PAYEE_REFERENCE>

<PAYMENT_MEANS PAYMENT_MEANS_CODE="58">SEPA credit transfer</PAYMENT_MEANS>

<DETAILS_OF_PAYMENT>

<FI_PAYMENT_REFERENCE>54321</FI_PAYMENT_REFERENCE>

</DETAILS_OF_PAYMENT>

<BANK_BARCODE>

<FI_BANK_BARCODE>12345</FI_BANK_BARCODE>

</BANK_BARCODE>

</PAYEE>

<INVOICE_RECIPIENT>

<CUSTOMER_INFORMATION>

<CUSTOMER_NAME>INVOICE_RECIPIENT/CUSTOMER_NAME1</CUSTOMER_NAME>

<CUSTOMER_NAME>INVOICE_RECIPIENT/CUSTOMER_NAME2</CUSTOMER_NAME>

<CUSTOMER_ID SCHEME_ID="0037">003733333338</CUSTOMER_ID>

<ADDRESS>

<STREET_ADDRESS1>INVOICE_RECIPIENT/STREET_ADDRESS1</STREET_ADDRESS1>

<SUBDIVISION>INVOICE_RECIPIENT/SUBDIVISION</SUBDIVISION>

<POSTAL_CODE>INVOICE_RECIPIENT/POSTAL_CODE</POSTAL_CODE>

<POST_OFFICE>INVOICE_RECIPIENT/POST_OFFICE</POST_OFFICE>

<COUNTRY>Finland</COUNTRY>

<COUNTRY_CODE>FI</COUNTRY_CODE>

</ADDRESS>

<TRADING_NAME>INVOICE_RECIPIENT/TRADING_NAME</TRADING_NAME>

<VAT_REG>Registration pending</VAT_REG>

<VAT_NUMBER>FI33333311</VAT_NUMBER>

<ORGANIZATION_NUMBER>3333331-1</ORGANIZATION_NUMBER>

<PARTY_IDENTIFICATION_ID AUTHORITY="EDI" SCHEME_ID="0037">003733333321</PARTY_IDENTIFICATION_ID>

<TRADE_REGISTRY_NUMBER>333</TRADE_REGISTRY_NUMBER>

<SITE>3333</SITE>

<ORGANIZATION_DEPARTMENT>INVOICE_RECIPIENT/ORGANIZATION_DEPARTMENT1</ORGANIZATION_DEPARTMENT>

<CONTACT_INFORMATION>

<CONTACT_PERSON>INVOICE_RECIPIENT/CONTACT_PERSON</CONTACT_PERSON>

<CONTACT_PERSON_FUNCTION>INVOICE_RECIPIENT/CONTACT_PERSON_FUNCTION</CONTACT_PERSON_FUNCTION>

<DEPARTMENT>INVOICE_RECIPIENT/DEPARTMENT</DEPARTMENT>

<TELEPHONE_NUMBER>040 3333 333</TELEPHONE_NUMBER>

<TELEFAX_NUMBER>09-3333 333</TELEFAX_NUMBER>

<E-MAIL_ADDRESS>email@invoice_recipient.com</E-MAIL_ADDRESS>

</CONTACT_INFORMATION>

<LANGUAGE_CODE>FI</LANGUAGE_CODE>

<NOTE>NOTE</NOTE>

<FREE_TEXT TEXT_TYPE="TextType">FREE_TEXT</FREE_TEXT>

</CUSTOMER_INFORMATION>

</INVOICE_RECIPIENT>

<RECEIVER>

<CUSTOMER_INFORMATION>

<CUSTOMER_NAME>RECEIVER/CUSTOMER_NAME1</CUSTOMER_NAME>

<CUSTOMER_NAME>RECEIVER/CUSTOMER_NAME2</CUSTOMER_NAME>

<CUSTOMER_ID SCHEME_ID="0037">003722222237</CUSTOMER_ID>

<ADDRESS>

<STREET_ADDRESS1>RECEIVER/STREET_ADDRESS1</STREET_ADDRESS1>

<SUBDIVISION>RECEIVER/SUBDIVISION</SUBDIVISION>

<POSTAL_CODE>RECEIVER/POSTAL_CODE</POSTAL_CODE>

<POST_OFFICE>RECEIVER/POST_OFFICE</POST_OFFICE>

<COUNTRY>Finland</COUNTRY>

<COUNTRY_CODE>FI</COUNTRY_CODE>

</ADDRESS>

<TRADING_NAME>RECEIVER/TRADING_NAME</TRADING_NAME>

<VAT_REG>Registration pending</VAT_REG>

<VAT_NUMBER>FI22222210</VAT_NUMBER>

<ORGANIZATION_NUMBER>2222221-0</ORGANIZATION_NUMBER>

<PARTY_IDENTIFICATION_ID AUTHORITY="EDI" SCHEME_ID="0037">003722222229</PARTY_IDENTIFICATION_ID>

<TRADE_REGISTRY_NUMBER>222</TRADE_REGISTRY_NUMBER>

<SITE>2222</SITE>

<ORGANIZATION_DEPARTMENT>RECEIVER/ORGANIZATION_DEPARTMENT1</ORGANIZATION_DEPARTMENT>

<ORGANIZATION_DEPARTMENT>RECEIVER/ORGANIZATION_DEPARTMENT2</ORGANIZATION_DEPARTMENT>

<CONTACT_INFORMATION>

<CONTACT_PERSON>RECEIVER/CONTACT_PERSON</CONTACT_PERSON>

<CONTACT_PERSON_FUNCTION>RECEIVER/CONTACT_PERSON_FUNCTION</CONTACT_PERSON_FUNCTION>

<DEPARTMENT>RECEIVER/DEPARTMENT</DEPARTMENT>

<TELEPHONE_NUMBER>040 2222 222</TELEPHONE_NUMBER>

<TELEFAX_NUMBER>09-2222 222</TELEFAX_NUMBER>

<E-MAIL_ADDRESS>email@receiver.com</E-MAIL_ADDRESS>

</CONTACT_INFORMATION>

<LANGUAGE_CODE>FI</LANGUAGE_CODE>

<NOTE>Note</NOTE>

<FREE_TEXT TEXT_TYPE="TextType">FreeText</FREE_TEXT>

</CUSTOMER_INFORMATION>

<NET_SERVICE_ID>003722222202</NET_SERVICE_ID>

<INTERMEDIATOR>RECEIVER_INTERMEDIATOR</INTERMEDIATOR>

</RECEIVER>

<DELIVERER>

<CUSTOMER_INFORMATION>

<CUSTOMER_NAME>DELIVERER/CUSTOMER_NAME1</CUSTOMER_NAME>

<CUSTOMER_NAME>DELIVERER/CUSTOMER_NAME2</CUSTOMER_NAME>

<CUSTOMER_ID SCHEME_ID="0037">003755555531</CUSTOMER_ID>

<ADDRESS>

<STREET_ADDRESS1>DELIVERER/STREET_ADDRESS1</STREET_ADDRESS1>

<STREET_ADDRESS2>DELIVERER/STREET_ADDRESS2</STREET_ADDRESS2>

<SUBDIVISION>DELIVERER/SUBDIVISION</SUBDIVISION>

<POSTAL_CODE>DELIVERER/POSTAL_CODE</POSTAL_CODE>

<POST_OFFICE>DELIVERER/POST_OFFICE</POST_OFFICE>

<COUNTRY>Finland</COUNTRY>

<COUNTRY_CODE>FI</COUNTRY_CODE>

</ADDRESS>

<TRADING_NAME>DELIVERER/TRADING_NAME</TRADING_NAME>

<VAT_REG>Registration pending</VAT_REG>

<VAT_NUMBER>FI55555513</VAT_NUMBER>

<ORGANIZATION_NUMBER>5555551-3</ORGANIZATION_NUMBER>

<PARTY_IDENTIFICATION_ID AUTHORITY="EDI" SCHEME_ID="0037">003755555521</PARTY_IDENTIFICATION_ID>

<TRADE_REGISTRY_NUMBER>555</TRADE_REGISTRY_NUMBER>

<SITE>5555</SITE>

<ORGANIZATION_DEPARTMENT>DELIVERER/ORGANIZATION_DEPARTMENT1</ORGANIZATION_DEPARTMENT>

<ORGANIZATION_DEPARTMENT>DELIVERER/ORGANIZATION_DEPARTMENT2</ORGANIZATION_DEPARTMENT>

<CONTACT_INFORMATION>

<CONTACT_PERSON>DELIVERER/CONTACT_PERSON</CONTACT_PERSON>

<CONTACT_PERSON_FUNCTION>DELIVERER/CONTACT_PERSON_FUNCTION</CONTACT_PERSON_FUNCTION>

<DEPARTMENT>DELIVERER/DEPARTMENT</DEPARTMENT>

<TELEPHONE_NUMBER>040 5555 555</TELEPHONE_NUMBER>

<TELEFAX_NUMBER>09-5555 555</TELEFAX_NUMBER>

<E-MAIL_ADDRESS>email@deliverer.com</E-MAIL_ADDRESS>

</CONTACT_INFORMATION>

<LANGUAGE_CODE>FI</LANGUAGE_CODE>

<NOTE>Note</NOTE>

<FREE_TEXT TEXT_TYPE="TextType">FREE_TEXT</FREE_TEXT>

</CUSTOMER_INFORMATION>

</DELIVERER>

<DELIVERY_PARTY>

<CUSTOMER_INFORMATION>

<CUSTOMER_NAME>DELIVERY_PARTY/CUSTOMER_NAME1</CUSTOMER_NAME>

<CUSTOMER_ID SCHEME_ID="0037">003744444439</CUSTOMER_ID>

<ADDRESS>

<STREET_ADDRESS1>DELIVERY_PARTY/STREET_ADDRESS1</STREET_ADDRESS1>

<SUBDIVISION>DELIVERY_PARTY/SUBDIVISION</SUBDIVISION>

<POSTAL_CODE>DELIVERY_PARTY/POSTAL_CODE</POSTAL_CODE>

<POST_OFFICE>DELIVERY_PARTY/POST_OFFICE</POST_OFFICE>

<COUNTRY_CODE>FI</COUNTRY_CODE>

</ADDRESS>

<VAT_REG>Registration pending</VAT_REG>

<ORGANIZATION_NUMBER>4444441-2</ORGANIZATION_NUMBER>

<PARTY_IDENTIFICATION_ID AUTHORITY="EDI" SCHEME_ID="0037">003744444420</PARTY_IDENTIFICATION_ID>

<TRADE_REGISTRY_NUMBER>444</TRADE_REGISTRY_NUMBER>

<SITE>4444</SITE>

<ORGANIZATION_DEPARTMENT>DELIVERY_PARTY/ORGANIZATION_DEPARTMENT1</ORGANIZATION_DEPARTMENT>

<ORGANIZATION_DEPARTMENT>DELIVERY_PARTY/ORGANIZATION_DEPARTMENT2</ORGANIZATION_DEPARTMENT>

<CONTACT_INFORMATION>

<CONTACT_PERSON>DELIVERY_PARTY/CONTACT_PERSON</CONTACT_PERSON>

<CONTACT_PERSON_FUNCTION>DELIVERY_PARTY/CONTACT_PERSON_FUNCTION</CONTACT_PERSON_FUNCTION>

<DEPARTMENT>DELIVERY_PARTY/DEPARTMENT</DEPARTMENT>

<TELEPHONE_NUMBER>040 4444 444</TELEPHONE_NUMBER>

<TELEFAX_NUMBER>09-4444 444</TELEFAX_NUMBER>

<E-MAIL_ADDRESS>email@delivery_party.com</E-MAIL_ADDRESS>

</CONTACT_INFORMATION>

<LANGUAGE_CODE>FI</LANGUAGE_CODE>

<NOTE>Note</NOTE>

<FREE_TEXT TEXT_TYPE="TextType">FREE_TEXT</FREE_TEXT>

</CUSTOMER_INFORMATION>

</DELIVERY_PARTY>

<ROWS>

<ROW>

<ARTICLE>

<ARTICLE_ID>1002345</ARTICLE_ID>

<ARTICLE_NAME>Tuote K*P 4,2X 16 ZN 500/RS</ARTICLE_NAME>

<EAN_CODE SCHEME_ID="0123">ENARI0123</EAN_CODE>

</ARTICLE>

<QUANTITY>

<ORDERED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">1.000</ORDERED>

<DELIVERED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">1.000</DELIVERED>

<CHARGED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">1.000</CHARGED>

</QUANTITY>

<INVOICED_OBJECT SCHEME_ID="ABT">ID1234</INVOICED_OBJECT>

<ORDER_NUMBER>001</ORDER_NUMBER>

<ORDER_INFORMATION ORDER_TYPE="CO">

<ORDER_NUMBER>1</ORDER_NUMBER>

<ORDER_DATE>

<DATE>

<DAY>31</DAY>

<MONTH>12</MONTH>

<CENTURY>20</CENTURY>

<DECADE_AND_YEAR>21</DECADE_AND_YEAR>

</DATE>

</ORDER_DATE>

<ORDER_POSITION>21</ORDER_POSITION>

</ORDER_INFORMATION>

<PROJECT_INFORMATION PROJECT_TYPE="PROJECT_TYPE">

<PROJECT_NUMBER>PROJECT_NUMBER</PROJECT_NUMBER>

<PROJECT_TITLE>PROJECT_TITLE</PROJECT_TITLE>

<FREE_TEXT TEXT_TYPE="TEXT_TYPE">FREE_TEXT</FREE_TEXT>

</PROJECT_INFORMATION>

<DELIVERY_NUMBER>123456</DELIVERY_NUMBER>

<PRICE_PER_UNIT PR_UNIT="KPL" PR_UNIT_UNECE_CODE="H87">

<AMOUNT SIGN="+" VAT="EXCLUDED">75.00</AMOUNT>

</PRICE_PER_UNIT>

<ROW_TOTAL>

<AMOUNT SIGN="+" VAT="EXCLUDED">75.00</AMOUNT>

<AMOUNT SIGN="+" VAT="INCLUDED">93.00</AMOUNT>

</ROW_TOTAL>

<ROW_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">75.00</AMOUNT>

<AMOUNT SIGN="+" VAT="INCLUDED">93.00</AMOUNT>

</ROW_AMOUNT>

<VAT>

<RATE>24.00</RATE>

<VAT_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">18</AMOUNT>

</VAT_AMOUNT>

</VAT>

<FREE_TEXT>Tuotteen verollinen hinta 93 rivin verollinen arvo 93</FREE_TEXT>

</ROW>

<ROW>

<ARTICLE>

<ARTICLE_ID>1002346</ARTICLE_ID>

<ARTICLE_NAME>Tuote 4,2X13 ZN 500/RS</ARTICLE_NAME>

</ARTICLE>

<QUANTITY>

<ORDERED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">31.000</ORDERED>

<DELIVERED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">31.000</DELIVERED>

<CHARGED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">31.000</CHARGED>

</QUANTITY>

<ORDER_REFERENCE>ROW/ORDER_REFERENCE</ORDER_REFERENCE>

<ORDER_INFORMATION ORDER_TYPE="CO">

<ORDER_NUMBER>ROW/ORDER_INFO/ORDER_NUMBER</ORDER_NUMBER>

</ORDER_INFORMATION>

<PRICE_PER_UNIT>

<AMOUNT SIGN="+" VAT="EXCLUDED">0.32</AMOUNT>

</PRICE_PER_UNIT>

<ROW_TOTAL>

<AMOUNT SIGN="+" VAT="EXCLUDED">9.92</AMOUNT>

<AMOUNT SIGN="+" VAT="INCLUDED">12.20</AMOUNT>

</ROW_TOTAL>

<ROW_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">9.92</AMOUNT>

<AMOUNT SIGN="+" VAT="INCLUDED">12.20</AMOUNT>

</ROW_AMOUNT>

<VAT>

<RATE>23.00</RATE>

<VAT_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">2.28</AMOUNT>

</VAT_AMOUNT>

</VAT>

<FREE_TEXT>Tuotteen verollinen hinta 12,20 rivin verollinen arvo 12,20</FREE_TEXT>

</ROW>

<ROW>

<ARTICLE>

<ARTICLE_ID/>

<ARTICLE_NAME/>

</ARTICLE>

<QUANTITY>

<ORDERED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">0.000</ORDERED>

<DELIVERED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">0.000</DELIVERED>

<CHARGED Q_UNIT="KPL" Q_UNIT_UNECE_CODE="H87" SIGN="+">0.000</CHARGED>

</QUANTITY>

<ORDER_REFERENCE>ROW/ORDER_REFERENCE</ORDER_REFERENCE>

<ORDER_INFORMATION ORDER_TYPE="CO">

<ORDER_NUMBER>3</ORDER_NUMBER>

</ORDER_INFORMATION>

<PRICE_PER_UNIT>

<AMOUNT SIGN="+" VAT="EXCLUDED">0.00</AMOUNT>

</PRICE_PER_UNIT>

<ROW_TOTAL>

<AMOUNT SIGN="+" VAT="EXCLUDED">0.00</AMOUNT>

<AMOUNT SIGN="+" VAT="INCLUDED">0.00</AMOUNT>

</ROW_TOTAL>

<VAT>

<RATE>23.00</RATE>

<VAT_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">0.00</AMOUNT>

</VAT_AMOUNT>

</VAT>

<FREE_TEXT>FREE_TEXT example row without ARTICLE_NAME or ARTICLE_ID</FREE_TEXT>

</ROW>

<ROW>

<FREE_TEXT>FREE_TEXT example, ROW-element contains only FREE_TEXT tag</FREE_TEXT>

</ROW>

</ROWS>

<SUMMARY>

<ROWS_TOTAL>

<AMOUNT SIGN="+" VAT="EXCLUDED">84.92</AMOUNT>

</ROWS_TOTAL>

<INVOICE_TOTAL>

<AMOUNT SIGN="+" VAT="EXCLUDED">84.92</AMOUNT>

<AMOUNT SIGN="+" VAT="INCLUDED">104.45</AMOUNT>

</INVOICE_TOTAL>

<VAT_SUMMARY>

<RATE>23.000</RATE>

<ACCORDING>

<AMOUNT SIGN="+" VAT="EXCLUDED">84.92</AMOUNT>

</ACCORDING>

<VAT_RATE_TOTAL>

<AMOUNT SIGN="+">19.53</AMOUNT>

</VAT_RATE_TOTAL>

<VAT_GROUP_TOTAL>

<AMOUNT SIGN="+" VAT="INCLUDED">104.45</AMOUNT>

</VAT_GROUP_TOTAL>

<VAT_DESCRIPTION>VAT_DESCRIP.</VAT_DESCRIPTION>

<CURRENCY_CODE>EUR</CURRENCY_CODE>

</VAT_SUMMARY>

<VAT_TOTAL>

<AMOUNT SIGN="+">19.53</AMOUNT>

</VAT_TOTAL>

<ROUNDINGS>0.00</ROUNDINGS>

<DISCOUNT>

<DISCOUNT_NAME>DISCOUNT_NAME</DISCOUNT_NAME>

<DISCOUNT_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">5.00</AMOUNT>

</DISCOUNT_AMOUNT>

<VAT VAT_TYPE="S">

<RATE>23.00</RATE>

<VAT_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">1.15</AMOUNT>

</VAT_AMOUNT>

</VAT>

</DISCOUNT>

<DISCOUNTS_TOTAL>

<AMOUNT SIGN="+" VAT="EXCLUDED">5.00</AMOUNT>

</DISCOUNTS_TOTAL>

<CHARGES>

<CHARGE_NAME>CHARGE_NAME</CHARGE_NAME>

<CHARGE_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">5.00</AMOUNT>

</CHARGE_AMOUNT>

<VAT VAT_TYPE="S">

<RATE>23.00</RATE>

<VAT_AMOUNT>

<AMOUNT SIGN="+" VAT="EXCLUDED">1.15</AMOUNT>

</VAT_AMOUNT>

</VAT>

</CHARGES>

<CHARGES_TOTAL>

<AMOUNT SIGN="+" VAT="EXCLUDED">5.00</AMOUNT>

</CHARGES_TOTAL>

<FREE_TEXT>SUMMARY_FREE_TEXT</FREE_TEXT>

</SUMMARY>

</INVOICE>

</INVOICES>

</CONTENT_FRAME>

</INVOICE_CENTER>